2024.8. Week 2

1. "Time Grocery Store" topped the iOS free version on its first day of release

2. AI gamified learning products for children secured 3.5 million in funding

3. Game giant IGG released four casual mobile games

4. Microsoft plans to establish a new game studio within Blizzard

5. Hybe, the agency of BTS, secured 80 million in funding

6. South Korean metaverse virtual social platform secured 189 million in funding

7. TikTok tops the global mobile app comprehensive revenue chart for 2024

8. Several executives leave OpenAI

01. "Time Grocery Store" topped the iOS free version on its first day of release

Since its launch on August 1st, the mobile game "Time Grocery Store," released by 37Games, has shown strong performance, driven by an effective global marketing strategy. The game topped the iOS free chart on its first day and rose to 22nd place on the bestseller list by the weekend. The estimated revenue on the first day on iOS was $117,000, quickly growing to exceed $350,000 by August 4th, approximately 2.5 million Chinese Yuan. In the first four days, total revenue reached $940,000, or about 6.78 million Chinese Yuan.

Additionally, "Time Grocery Store" was initially launched overseas under the title "Shitamachi Dream ~ Heartfelt Human Love Story." After public testing began in Japan in February of the previous year, the game earned an estimated $830,000 in its first month, about 6 million Chinese Yuan, demonstrating a stable growth trend in initial revenue.

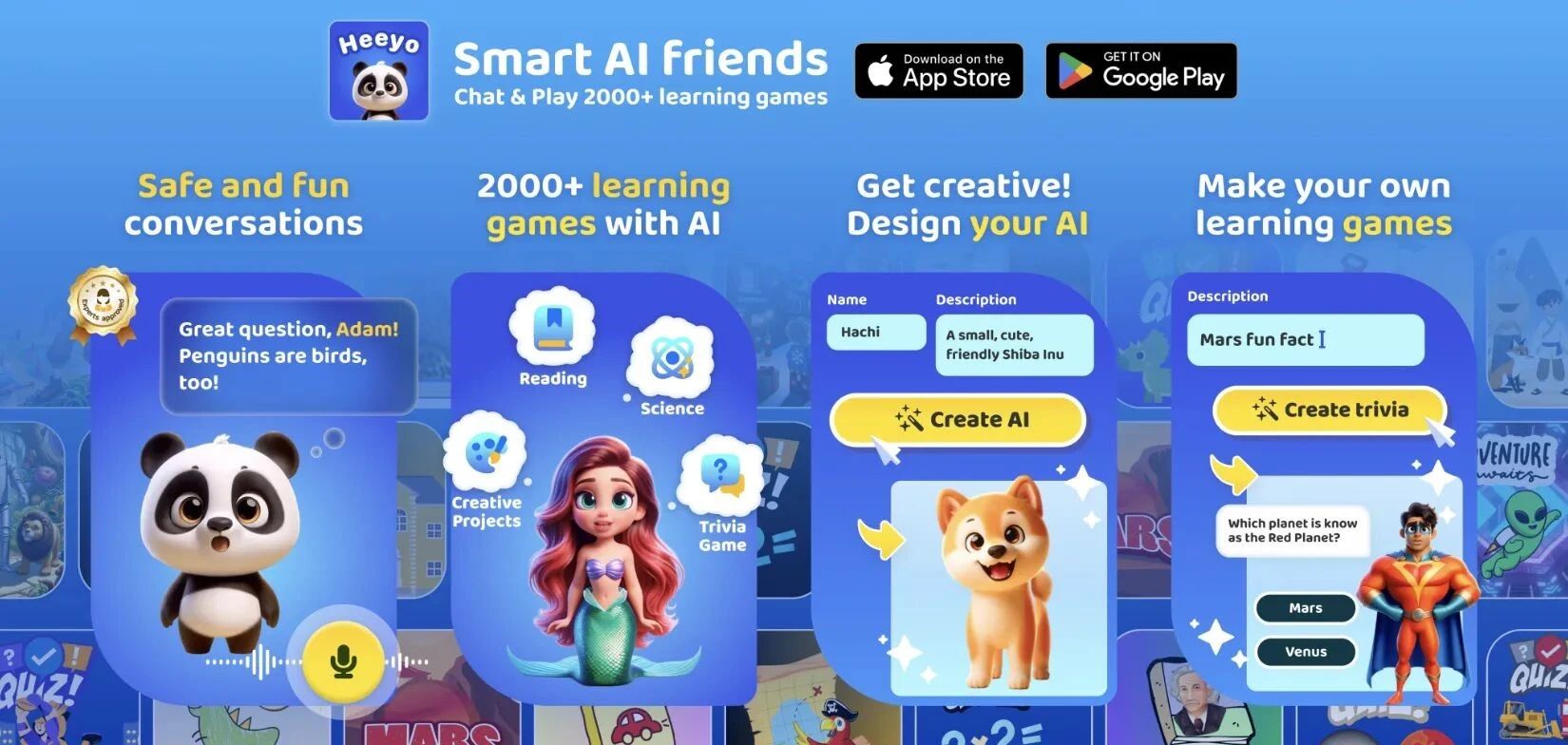

02. AI gamified learning products for children secured 3.5 million in funding

Chinese female founder Xiaoyin Qu created the AI-driven gamified learning product "Heeyo."

"Heeyo" is mainly targeted at children aged 3 to 11, offering an AI chatbot and over 2000 interactive games and activities, including books, knowledge quizzes, and role-playing adventures. Children can engage in learning conversations with AI, while parents can design their own AI characters to create learning games based on family values and children's interests. Each AI can speak 20 languages and has been trained by child psychologists to interact safely and enjoyably with children.

The product has experienced rapid growth and received a seed round of funding of $3.5 million from the OpenAI Startup Fund and other well-known investment institutions on August 1st. The latest valuation of the product exceeds $20 million.

03. Game giant IGG released four casual mobile games

IGG, a game company known for its heavy SLG products like "Lords Mobile" and "Viking Rise," is expanding its product line into the social gaming and large casual gaming sectors.

With the global mobile gaming market stabilizing, these two sectors have shown strong growth momentum, especially in puzzle games and party games, each achieving year-on-year growth in downloads and revenue. For example, Scopely's "MONOPOLY GO!" became the top-selling mobile game in Q2 2024, while "Match Factory" also achieved significant success in the puzzle game genre.

In this context, IGG is actively entering the casual mobile gaming arena.

IGG is actively testing new products on Google Play through its wholly-owned subsidiary, "SkyRise Digital Pte Ltd." Since the end of 2022, the company has launched multiple games, with 18 products released this year alone. These products include not only IGG's expertise in 4X SLG games and RPGs but also one casual game and three social gaming titles, accounting for nearly a quarter of its new product lineup. This indicates that IGG is actively exploring new market opportunities and seeking a breakthrough in the casual gaming sector.

04. Microsoft plans to establish a new game studio within Blizzard

There are reports that Microsoft is planning to establish a new game studio within Activision Blizzard, with most of the members coming from King, a casual mobile game developer under Activision Blizzard.

This new studio will focus on developing new games based on Blizzard game IPs, and these games are expected to support cross-platform functionality, allowing them to be used on the upcoming mobile app store for Xbox.

05. Hybe, the agency of BTS, secured 80 million in funding

South Korean entertainment agency Hybe has completed an $80 million new round of financing, which will be used to expand the company's gaming business.

Hybe is the agency for popular idol groups like BTS, Seventeen, and NewJeans.

In 2021, Hybe established the gaming division Hybe IM and launched official music games like "Rhythm Hive" and the BTS official match-three game "BTS Island: In the SEOM."

06. South Korean metaverse virtual social platform secured 189 million in funding

South Korean Naver Z's metaverse virtual social platform "Zepeto" recently completed a $189 million Series B financing round.

The main investor was SoftBank Group's Vision Fund 2 from Japan, which invested $150 million. The remaining funds came from South Korean financial company Future Asset, JYP Entertainment, HYBE Corporation (the agency for BTS), and YG Entertainment, totaling around $41 million.

Following the funding round, the valuation of "Zepeto" has exceeded $1 billion.

Naver Z plans to use this funding to expand its global services and talent recruitment to gain a more significant position in the metaverse field.

07. TikTok tops the global mobile app comprehensive revenue chart for 2024

On August 7th, Sensor Tower released the "Insights into the 2024 Asia-Pacific Publisher Non-Game App Market" report.

The report indicates that in the first half of 2024, the popularity of 'TikTok' continued to rise, with a month-on-month revenue increase of 8%, reaching $26 billion, ranking first in global mobile app (including games) comprehensive revenue. At the same time, 'TikTok' also emerged as the double champion in revenue growth and download volume for non-game apps in the Asia-Pacific region.

During the same period, the total revenue of non-game apps from the top 30 publishers in the Asia-Pacific region increased by 20% year-on-year, surpassing $6.5 billion. The revenue of short video apps increased fourfold month-on-month, with a cumulative global revenue exceeding $700 million. These data demonstrate the strong performance and growth momentum of 'TikTok' and the short video app sector in the mobile app market.

08. Several executives leave OpenAI

On August 6th, John Schulman, co-founder of OpenAI and long-time leader of the OpenAI reinforcement learning team and alignment research, announced his departure from OpenAI on Twitter and stated that he would be joining Anthropic, a competitor to OpenAI.

At the same time, Greg Brockman, co-founder and president of OpenAI, announced that he would be on leave until the end of the year.

According to TechCrunch, Peter Deng, vice president of product at OpenAI, has also reportedly resigned.

The departure of multiple executives and co-founders from OpenAI in less than a year has raised concerns about the company's future. This shakeup is drawing parallels to the challenges faced by companies in other sectors, including mobile marketing examples, where leadership changes can impact overall strategy and market positioning.