SLG Mobile Marketing: "Age of Empires Mobile" Drives Global Success

Looking back at the first half of this year, several Chinese overseas SLG products have made a splash. First Fun's "Last War: Survival Game" broke the $100 million revenue mark within 5 months of its launch; Century Games’ "Whiteout Survival" has also surpassed $1 billion in global cumulative revenue as of August this year. Faced with the slowing growth of the global SLG market, these two games have successfully broken through with the innovative approach of introducing "mid-core elements".

If "turning heavy into light" is the new breakthrough variable for SLG games, then turning major IPs into mobile games is an even bolder strategy.With the classic IP "Age of Empires" on its side, Tencent's "Age of Empires Mobile" achieved remarkable success in just its first month.

01/ Nostalgia Marketing, Polarized Performances and Reputations

Since its debut in 1997, the "Age of Empires" series has released over a dozen versions, with global sales surpassing tens of millions, amassing a large following and exerting a profound and enduring influence in the gaming world.

"Age of Empires Mobile" tapped into the nostalgia and clout of the franchise for its pre-launch promotion, recreating iconic scenes in ads and pushing civilization lore, gameplay, and trailers on social platforms like Facebook and YouTube. This sparked excitement among old fans and drew new ones in. With 3 million pre-registrations in just half a month before launch, it built a solid foundation for its official release.

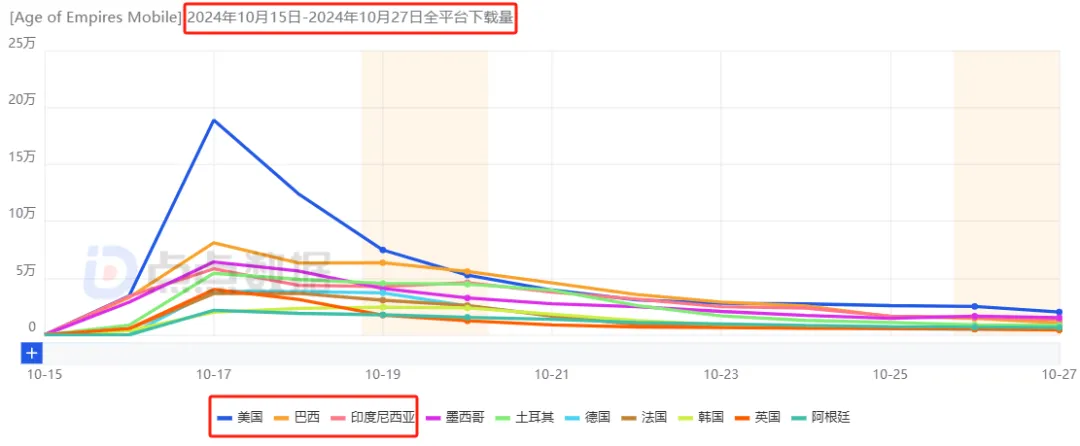

"Age of Empires Mobile" launched with 990k+ downloads, leading free iOS charts in 96 countries. It hit 4.71 million downloads in 11 days and earned over $130 million in 20, with a daily peak of $6 million, expecting to surpass $150 million in 30 days.

However, the game's impressive numbers are met with mixed reviews from players.

Original PC fans criticize "Age of Empires Mobile" for its initial gameplay, which is mostly about frantic button tapping and level grinding, lacking depth. The game's core RTS elements are minimal, with only basic unit deployment, missing the true RTS experience. It's also plagued with ads and seems more about resource gathering and in-app purchases, feeling more like a money-making scheme than an engaging game. Overall, the game is seen as inauthentic, monotonous, and overly commercialized.

Turning classic IPs into mobile games always stirs up debate, but that's exactly what's given "Age of Empires Mobile" a traffic surge right out of the gate. Yet, as a long-term SLG, striking the right balance between the original fans and new players in the later stages of "Age of Empires Mobile" is a challenge that warrants deep thought.

02/ Focusing on T1 Market For Ad Buying

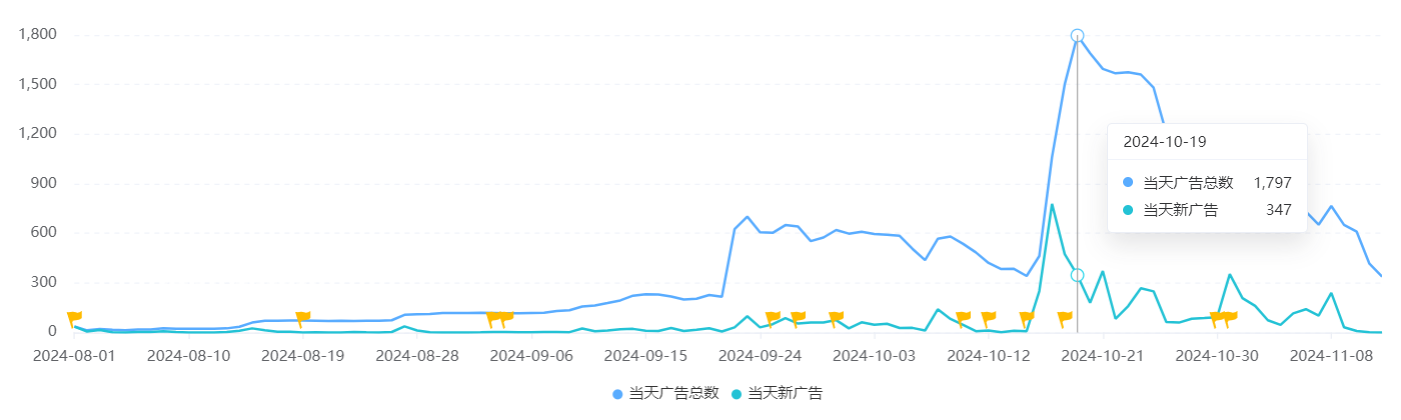

"Age of Empires Mobile" adopted a phased approach to ad buying. The game began testing ad placements in August with a relatively low volume. In the two weeks leading up to the launch, ad spending ramped up significantly, with an average of 600 ad sets per day. Post-launch on November 17th, the game entered a major promotion phase, with peak ad placements exceeding 1,700 sets in a day. As of November 12th, the game had deployed over 7,000 ad sets.

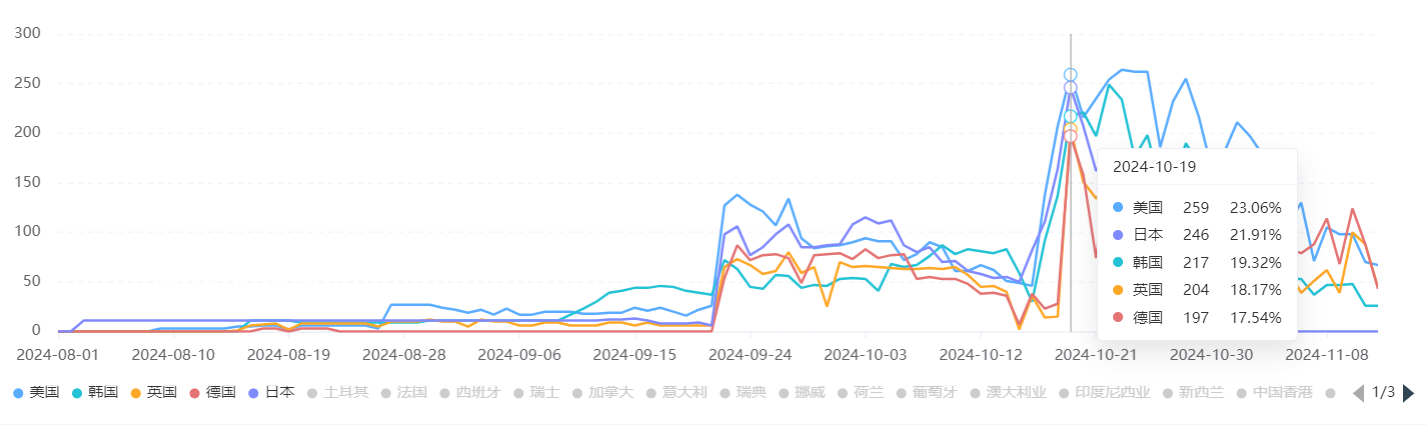

Globally launched, "Age of Empires Mobile" still banks heavily on Western and East Asian markets for user acquisition. The US, UK, and Germany lead with over 58% of the ad spend, followed by Japan and Korea at 41%. On day one, a notable boost in these key markets propelled the game to top download spots across multiple regions.

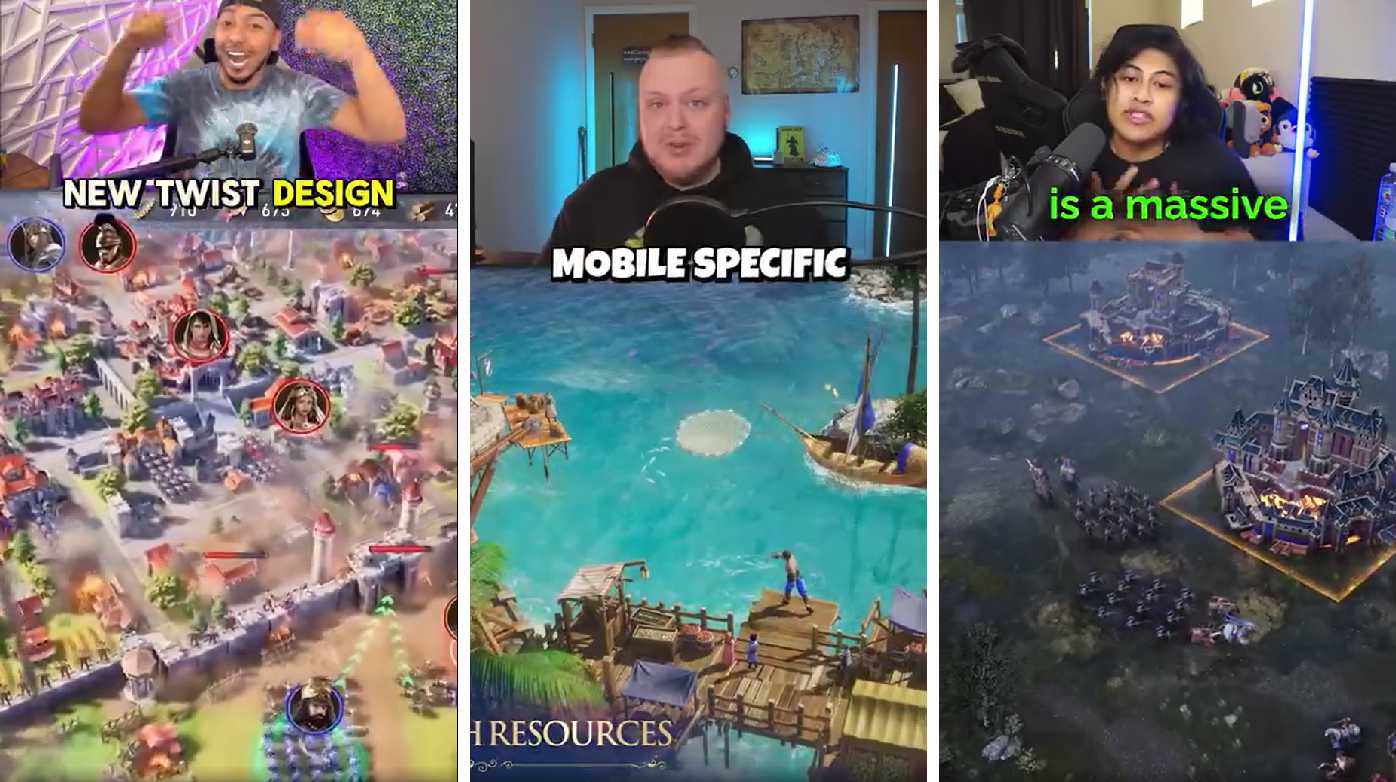

For ad types, "Age of Empires Mobile" favors video ads at 59.3% and image ads at 40.5%. The creatives often use high-quality promos and real people, tapping into the nostalgia of the "Age of Empires" brand to show game features and innovations, enhancing player interest and connection.

03/ Breaking Through SLG Growth Barriers

In SLG games, players over 26 make up more than 70% of the user base, which, despite not having high download volumes, leads in ARPD and LTV due to their loyalty and spending power. However, this valuable audience also comes with higher acquisition costs, posing a challenge for SLG developers to find new users within a constrained pool.

"Last War" has successfully drawn in a more casual player base by incorporating light gameplay elements, while "Age of Empires Mobile" leverages its classic IP for a mobile adaptation, simplifying gameplay to attract audiences beyond the original fanbase. Both aim to grow their user base rather than just serve existing fans, signaling a shift in SLG markets towards broader appeal as a growth engine.