Since the implementation of China’s “Double Reduction” policy, domestic online education companies have been significantly impacted. On one hand, companies have adjusted their business strategies to adapt to the changing domestic environment; on the other hand, many have turned their attention to overseas markets to explore new growth opportunities.

The global online education market is booming, especially catalyzed by three years of the pandemic, and its scale continues to expand. According to Statista, the global online education market size reached $166.5 billion in 2023. In the mobile app sector, the market size is also steadily increasing, with leading product Duolingo seeing its annual revenue rise from $36 million in 2018 to $531 million in 2023, marking a compound annual growth rate (CAGR) of over 70%.

Against this backdrop of rapid growth in the overseas online education market, what are the key characteristics in terms of market size, retention rates, and renewal rates for educational apps? How do challenges and opportunities intertwine for companies expanding overseas?

01/ Global Educational App Market Overview

According to Business of Apps, the global educational app market has accelerated its growth during the pandemic, rising from $1.68 billion in 2018 to $5.93 billion in 2023, with a compound annual growth rate (CAGR) of about 27.6%. Regionally, North America remains the leading market, accounting for 44% of global revenue, followed by Asia-Pacific at 29%, Europe, the Middle East, and Africa (EMEA) at 21%, and Latin America at 6%.

Data Source:businessofapps.com

The number of educational apps globally (on both Google Play and Apple Store) peaked in 2017 but declined in subsequent years. In 2020–2021, due to the pandemic, the number of apps surged before tapering off, reaching 389,000 apps in 2023, slightly up from 387,000 in 2022. In terms of downloads, from 2018 to 2023, global educational app downloads showed fluctuating growth, reaching 930 million downloads in 2023. Additionally, educational app downloads tend to peak in the third quarter of each year as students return to school.

Data Source:businessofapps.com

Duolingo, thanks to its gamified learning approach and robust brand marketing, has become a global phenomenon. In 2023,Duolingo led the top ten mobile game apps in terms of in-app revenue, generating $316 million, with its user registration surpassing 500 million. Language learning app Babbel and classroom management tool ClassDojo ranked second and third, with $56 million and $29 million, respectively.

Data Source:businessofapps.com

02/ Educational App Retention Benchmark Analysis

Currently, most educational apps focus on fulfilling users’ short-term goals, such as exam preparation or professional certifications. As a result, retention rates and renewal rates show a significant dichotomy.

In terms of retention, educational apps are among the lowest for app categories. According to AppsFlyer, the average retention rate for educational apps on day 30 is just 2%. Adjust’s data offers a slightly more optimistic view, but still estimates that nearly 96% of users are lost by day 30.

Data Source:businessofapps.com

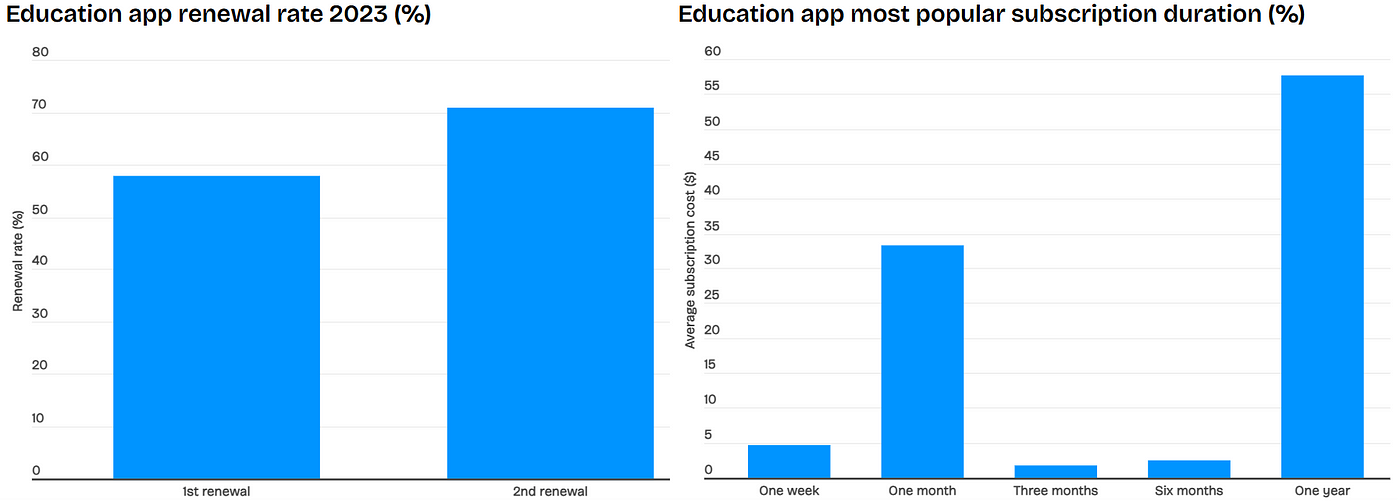

Educational apps also have relatively high renewal rates compared to other app categories, with first-time renewal rates reaching 57.92% and second-time renewal rates at 70.96%. Annual subscriptions are the most popular, with more than half of apps offering this option. Monthly subscriptions are the second most common, while weekly, quarterly, or six-month options are rarely available.

Data Source:businessofapps.com

There is little difference in pricing between weekly and monthly subscriptions, with the average costs being $6.10 and $8.13, respectively. Most educational apps aim to guide users toward annual subscriptions, offering significant discounts compared to monthly plans, with an average cost of $56.09. In terms of customer lifetime value (LTV) by region, North American users have the highest value, followed by Japan and South Korea, with 60-day LTVs of $0.55, $0.26, and $0.24, respectively.

Data Source:businessofapps.com

For educational apps, the conversion rate (the ratio of downloads to clicks on the app store page) is higher on Google Play than on iOS, at 34.4% and 18.11%, respectively.

Data Source:businessofapps.com

Almost all educational apps rely on brand reputation and social media for marketing, with usage rates of 83% and 77%, respectively. Email marketing and SEO are also commonly used at 58% and 52%, respectively.

Data Source:businessofapps.com

03/ Trends in Chinese Educational Apps Going Overseas

China has explored the “education going global” field for over a decade, transitioning from capital outflows to product exports.

As early as 2014, TAL Education Group invested in the innovative U.S. university Minerva as part of its overseas expansion. In recent years, China’s exploration of the education export sector has matured, shifting towards expanding international markets through self-developed products and localization strategies. Educational technology and online education have become key export sectors, particularly in areas like intelligent teaching, online course platforms, and AI-assisted education.

Source: Question.AI

Data shows that Chinese AI-powered education apps have gained wide popularity in international markets. For example, ByteDance’s Gauth, launched in 2021, has surpassed 14 million downloads, while Question.AI, launched by Zuoyebang in 2023, has already exceeded 25 million downloads.

Data Source:DuoJing, AppMagic

Although these overseas educational apps still lag behind the industry’s leading products, with continuous technological advancements and the diversification of global education demand, China’s education export market is poised for broader opportunities. In the future, overseas companies will rely on innovative teaching philosophies, advanced technology, and localized market strategies to integrate deeply into the global educational ecosystem.