Mid & Hard Core IAP Games Continue to Cash In, Top RPG & SLG Games Dominate South Korea Market

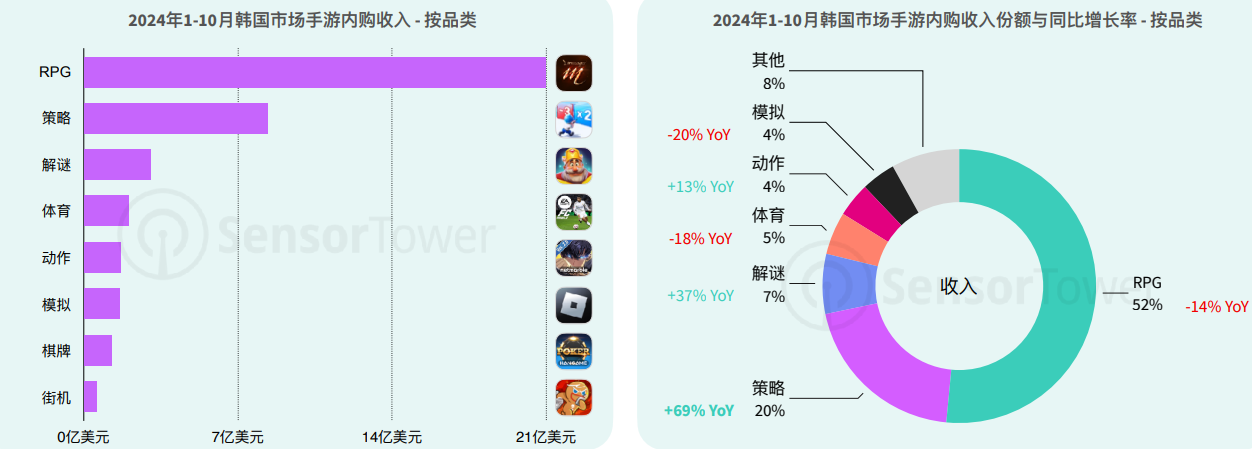

South Korea, the fourth-largest gaming market globally, is on a slow rebound after a sluggish 2023. Notably, mid-core mobile games, a dominant genre in the Korean market, have shown a significant resurgence. According to Sensor Tower data, strategy mobile games in the Korean market saw a 69% increase in revenue year-over-year in 2024, while RPG mobile games, particularly IAP games, accounted for 52% of the total mobile gaming revenue.

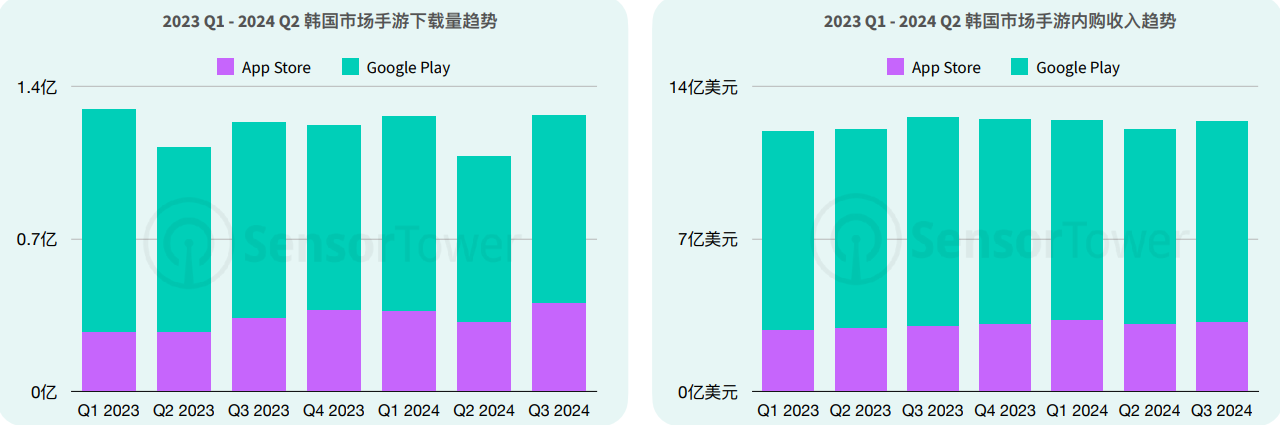

Beyond its stellar overall performance, the South Korean market has seen a surge of high-quality new releases and strong-performing top-tier mobile games, with downloads and revenue reaching 350 million and $3.7 billion in the first three quarters, respectively. So, how has the Korean mobile gaming market fared this year? What are the top products, and how have these mobile games driven growth?

01/Korean Mobile Game Market Overview

Sensor Tower reports a 17% QOQ increase in South Korean mobile game downloads, totaling 350 million in the first three quarters of 2024. Revenue hit $3.7 billion, with a 3% rise in Q3. Google Play leads with 70% of downloads and 75% of revenue.

In terms of genre revenue, mid-to-core mobile games, primarily RPGs and strategy games, dominate the South Korean market. RPGs, especially IAP games, lead the charge in revenue generation, with earnings exceeding $2.1 billion from January to October 2024, accounting for 52% of the total mobile game revenue in Korea. However, on a year-over-year basis, RPG revenue dipped by 14%. Strategy and puzzle IAP games, conversely, saw year-over-year increases of 69% and 37%, respectively.

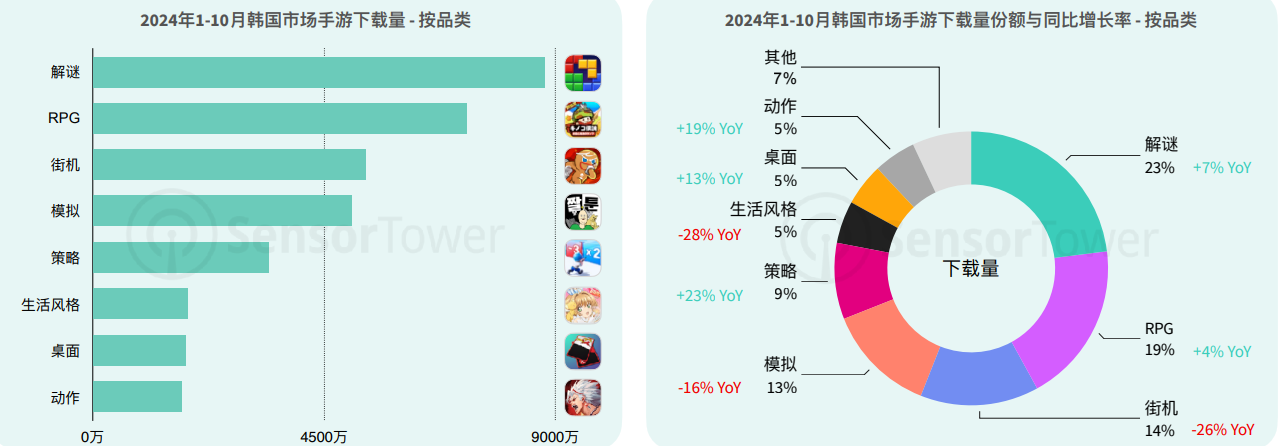

In terms of download volumes, mid-to-lightweight mobile games, led by puzzle games, maintain a leading position in the South Korean market. Puzzle IAP games accounted for 23% of total downloads in the first ten months of 2024, marking a 7% year-over-year increase. RPGs followed, claiming 19% of the share with a 4% quarter-over-quarter growth. Additionally, strategy, board, and action mobile games all saw different levels of increases in downloads, with respective gains of 23%, 13%, and 19%.

02 / Case Study on Top-Performing Products

The South Korean mobile gaming market saw dynamic growth in 2024, with 17 new games entering the top 100 in terms of revenue and 45 new games making it to the top 100 in downloads.

In the revenue rankings, Mid-to-core mobile games, particularly RPGs and SLGs, are big earners in South Korea. Eight of the top 10 new earners in the revenue chart are RPGs and SLGs, and they hold six spots in the overall revenue rankings. Netmarble's anime-style RPG "SoloLeveling: Arise" leads with over $45 million in South Korea and $140 million globally within six months. Two Chinese RPGs,“Wuthering Waves” and "Zenless Zone Zero", also cracked the top 10 of new game revenue.

On the download charts, there's a more balanced performance across genres. The strategy game "Lucky Defense," published by South Korean developer "111%," topped the new games download chart and ranked third overall.

Case one: "Lucky Defense"

"Lucky Defense," a cartoon-style strategy mobile game launched in May, has seen around 4.6 million downloads and $47 million in revenue worldwide. It combines tower defense with merging mechanics in a two-player, real-time match setup against monster waves. The game also incorporates "Roguelike" elements, featuring random hero summons and synthesis, adding replayability and unpredictability, setting it apart in the market.

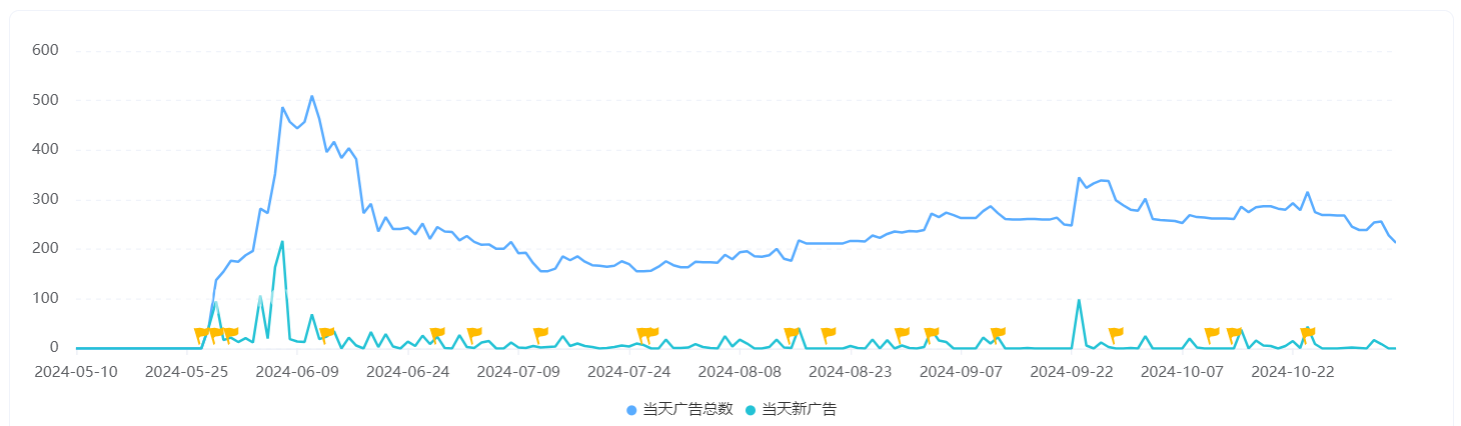

"Lucky Defense's" success is attributed to its solid user acquisition strategy, maintaining an average of 300 ad sets per day since launch. During its initial major push, it ramped up to over 400 ad sets daily, achieving 660,000 downloads within just half a month of its release.

Case two : “Wuthering Waves”

“Wuthering Waves” is a futuristic sci-fi RPG action game, known for its distinctive character designs, rich combat mechanics, and open-world exploration. It blends the action genre's fast-paced gameplay with RPG depth, delivering a challenging and engaging virtual experience. The game has garnered considerable attention since its release.

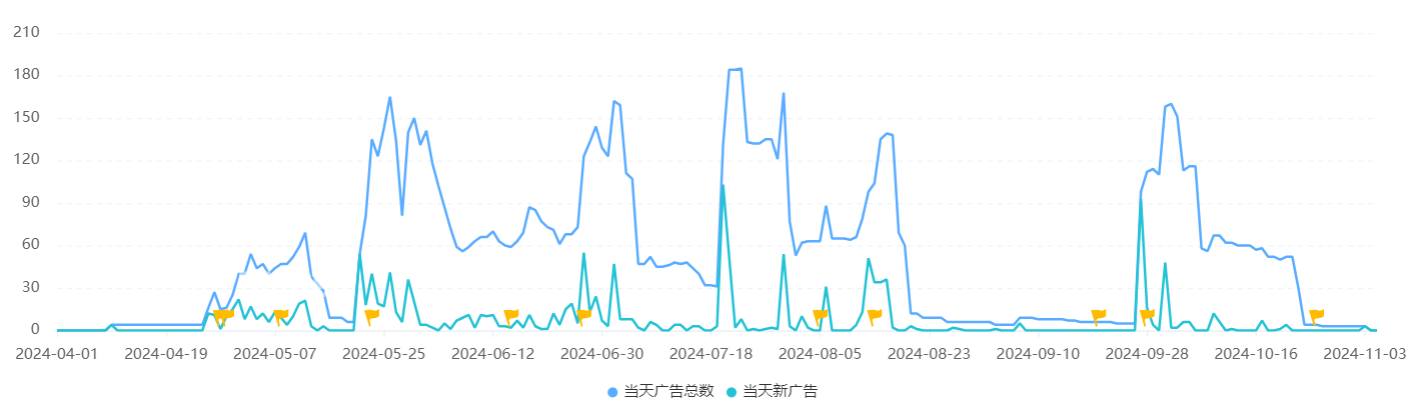

In term of Ad buying, “Wuthering Waves” has ramped up ad spending in South Korea

since its May launch, peaking at over 120 ads a day. The game now has over 220,000 monthly active users in South Korea and generates over 10 million RMB in monthly revenue.

Despite mid-to-core mobile games still dominating the South Korean market, the trend suggests that "lightweight" and "hybrid gameplay" hold more potential.

"Last War: Survival," which ranks second in revenue, emphasizes "casual side gameplay" in its marketing, integrating it into the core game design. This approach lightens the traditional SLG strategy component and expands its player base. A year post-launch, the game shows enduring strength, with a 33x increase in South Korean revenue from January to October 2024, hitting $250 million, or 21.4% of its global earnings.

03 / Strategies for Growth in Mid & Hard core Mobile Games

Mid & hard core mobile games continue to dominate the ad spend in South Korea, with RPGs and strategy games leading the charge in the first half of 2024, ranking first and second in monthly ad volume respectively. However, effectively managing ad campaigns and selecting the right channels remain key concerns for advertisers.

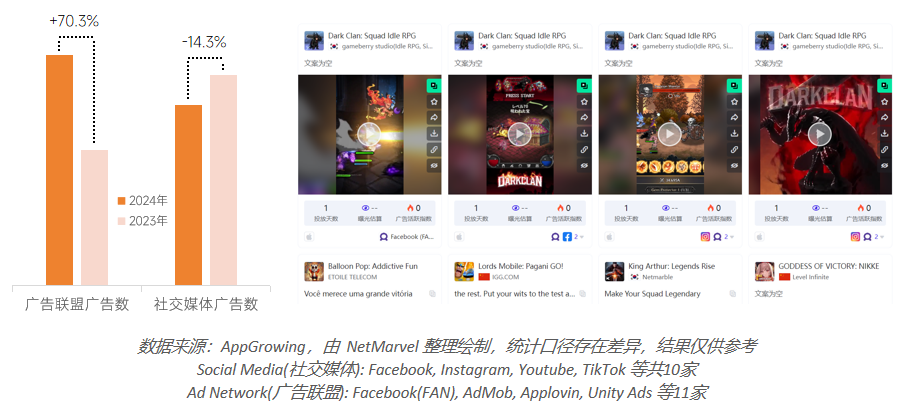

According to AppGrowing data, advertisers' strategies have seen a significant shift in recent years, moving away from relying solely on major media for ad placements. From January to October 2024, ad numbers on Ad Networks grew by 70.3% year-over-year, while ads on major media channels dropped by 14.3%, indicating a strong surge in Ad Network channels.

Advertisers are increasingly moving away from the traditional strategy of "putting all eggs in one basket" towards a more flexible and diversified approach to user acquisition.

NetMarvel, a top-tier global performance marketing platform, provides advertisers with comprehensive growth solutions. It taps into a global pool of IAA and IAP traffic across gaming, utilities, and social media, with over 100 million monthly active users. Using its own algorithms, NetMarvel helps advertisers build efficient user acquisition models, targeting high-ROAS and pinpointing valuable users.

NetMarvel also has a vast live streaming traffic pool, partnering with more than 100 local teams across gaming and social media. This helps advertisers match their audience with suitable live streams, quickly ramp up with better budget allocation, and scale product growth.