For marketers, the fourth quarter is undoubtedly one of the most critical business periods of the year. With the arrival of global shopping events like Black Friday and Christmas, advertisers boost their budgets in pursuit of higher Return on Ad Spend (ROAS). The marketing competition during this phase is intense, with a surge in ad buying, leading to higher CPM (Cost Per Thousand Impressions) and CPC (Cost Per Click) compared to other periods.

However, with the intensification of market competition, the marketing battle lines are continuously being extended. The traditional peak of the fourth quarter doesn't end with Christmas, but rather continues into late January of the following year, which has come to be known in the industry as the “Fifth Quarter (Q5)”. During this time, while the consumer frenzy slowly fades, the market remains active.

Why is “Q5” Gaining More Attention Among Marketers?

The rising popularity of Q5 among marketers can primarily be attributed to the unique and efficient opportunity it offers. Advertisers can capitalize on this period after the intense holiday season to acquire high-quality users and improve conversion rates with more flexible strategies.

On one hand, the cost of advertising during Q5 tends to be lower. During the peak periods of Black Friday through Christmas, advertising competition is fierce, and both CPM and CPC generally spike. However, post-holiday, many small and medium-sized advertisers, or brands with limited budgets, cut back on their spending, resulting in decreased competition and lower advertising costs. For advertisers with ample budgets, this presents a valuable opportunity to reach their target audience at a reduced cost. According to data from the Chinese overseas attribution platform Varos, CPM on major media channels like Meta, Google, and TikTok dropped by 15%-30% from Christmas to the second week of the new year.

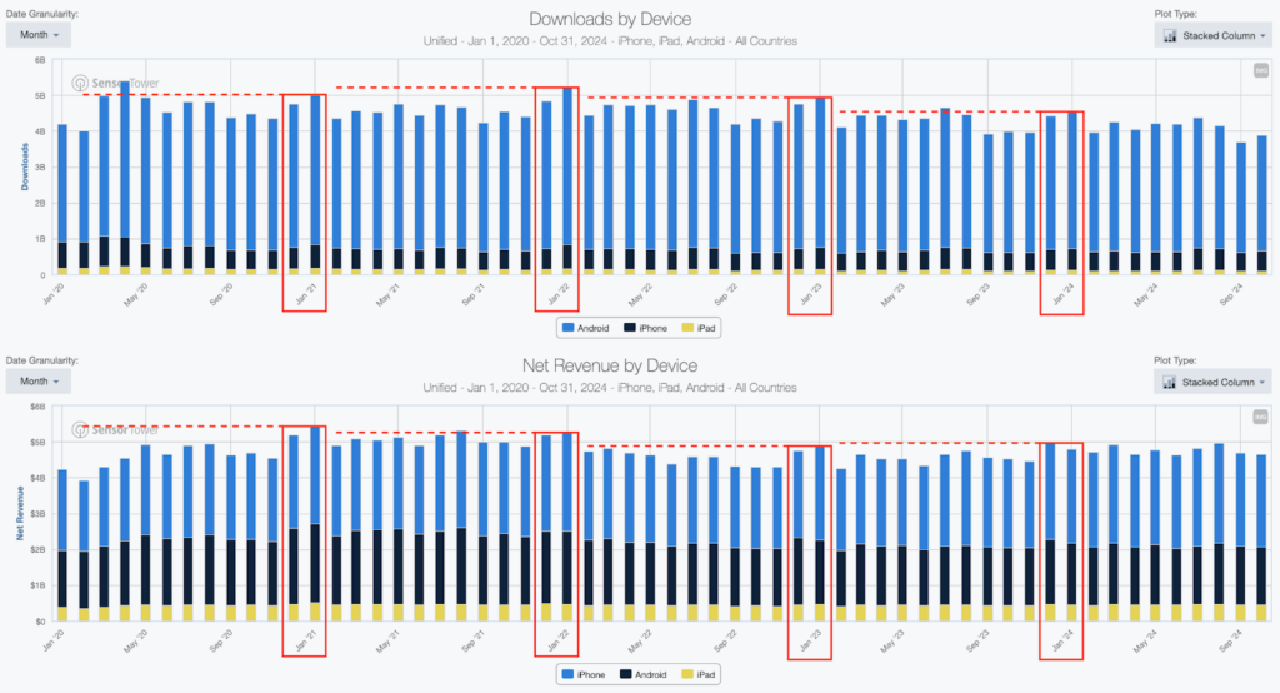

On the other hand, users remain active online during the Q5 period. December and January are a busy holiday season for many countries, meaning users spend more time on online entertainment and gaming. Data from Sensor Tower shows that December and January are typically among the highest months for app downloads and in-app purchase (IAP) revenue. For mobile marketers, this represents a prime opportunity to acquire users with high ROAS.

Q5 Ad Spending Trends

Q5 Ad Spending Trends

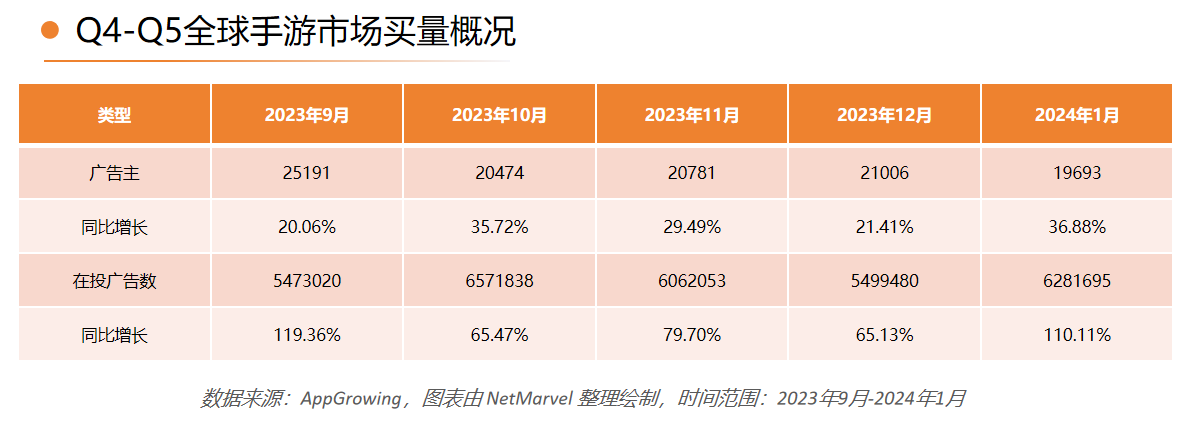

Looking at the ad-buying landscape, the increasing focus on Q5 is evident.

Taking the mobile gaming industry as an example, although overall ad spending slightly declined in December 2023, there was a significant rebound in January 2024, with total ad spend even surpassing November 2023 levels. Year-over-year, there was a 110% increase in ad volume. As for the number of products being advertised, while the number of advertisers in Q5 slightly decreased compared to previous months, the year-on-year increase was still notable.

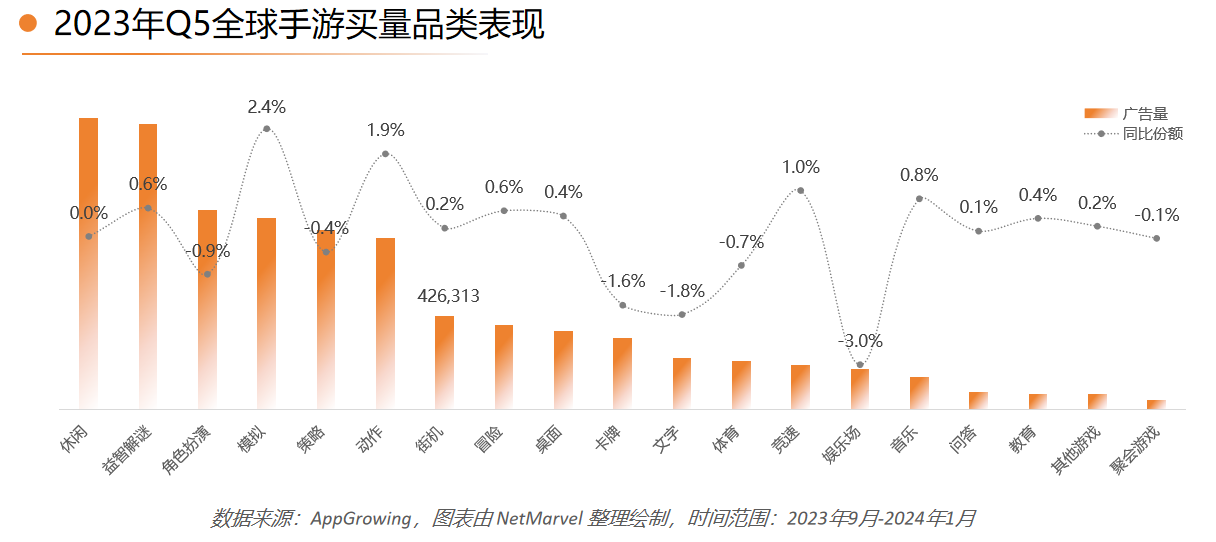

When looking at categories, the Q5 mobile ad-buying market continues to be dominated by casual APP games, particularly puzzle and casual games, which have performed exceptionally well. Role-playing games (RPGs) and simulation games also play an important role. The growth in ad-buying shares of simulation, action, and racing games is particularly noteworthy, with increases of 2.4%, 1.9%, and 1.0%, respectively. In contrast, card, text-based, and entertainment games saw a decline in their ad-buying shares compared to last year.

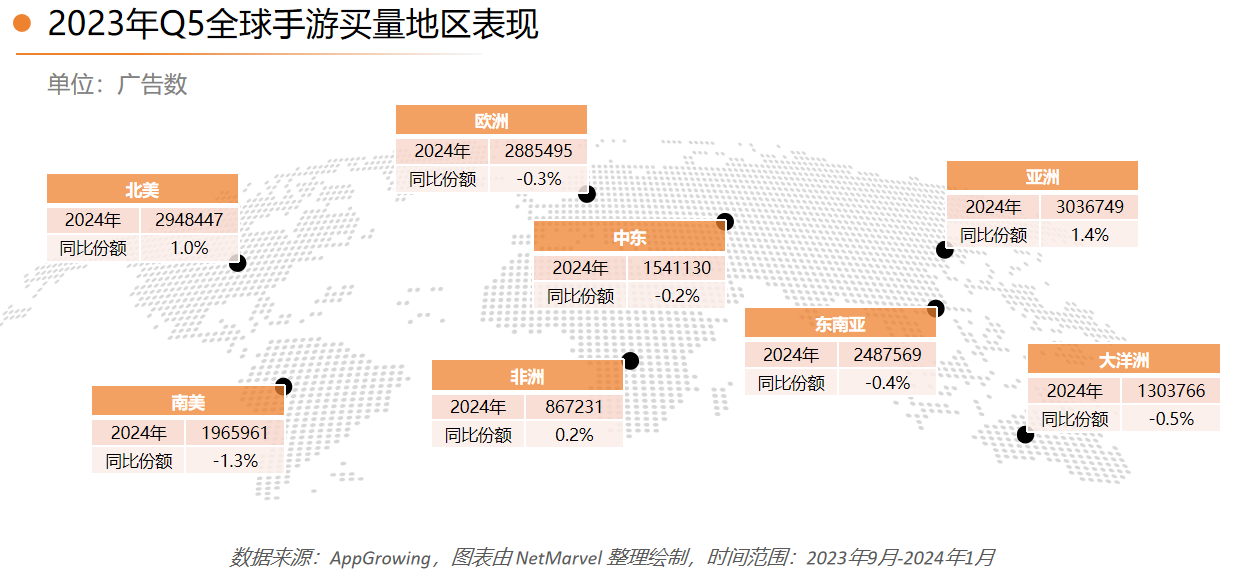

In terms of regions, Asia (excluding Mainland China), North America, and Europe remain the top three markets for APP ad spend during Q5. Asia and North America saw year-on-year growths of 1.4% and 1.0%, indicating a continued increase in user demand and advertiser interest, reflecting a high level of market vitality. Europe, however, saw a slight decline. The Southeast Asian market showed weaker performance, placing it in the second-tier. Markets like the Middle East, Oceania, and South America are in the third-tier.

Overall, the Q5 period for APP gaming ads shows a clear growth trend, especially in casual, simulation, and action games in the Asia and North American markets. Advertisers' focus and investment are gradually increasing.

Q5 APP Marketing Recommendations for Advertisers

1. Plan Ahead with a Comprehensive Strategy

During Q5, while the period is short, the potential is significant. Advertisers should plan ahead and prepare strategies that target key dates, user segments, and special holiday promotions. By understanding user behavior data from previous Q5 periods, advertisers can predict trends and adjust their ad strategies accordingly to ensure optimal resource allocation.

2. Launch Holiday Subscription Packages and Activities

To align with the festive atmosphere, advertisers can offer exclusive holiday subscription packages or in-app activities to attract users, such as ad-free gameplay, exclusive content, or reward-based features. These initiatives can not only drive new user acquisition but also improve retention, increase activity levels among existing users, and ultimately boost revenue.

3. Adjust Ad Budgets and Bidding Strategies

As user activity peaks during the holidays, advertisers should adjust their ad budgets and bidding strategies to maximize user acquisition. By closely monitoring the performance of campaigns, such as user retention, ad engagement, and in-app purchase activities, advertisers can quickly make adjustments and optimize for higher ROAS during the peak traffic period.

4. Leverage Opportunities with New Device Users

During the holidays, the purchase of new phones spikes, with many users downloading and installing a large number of apps right after purchasing a new device. Advertisers should design targeted ad strategies for this group, such as displaying apps at the initial touchpoint after device unboxing. Using innovative ad formats like in-device ads can help attract new users and, through continuous user engagement, increase long-term retention and ROI.