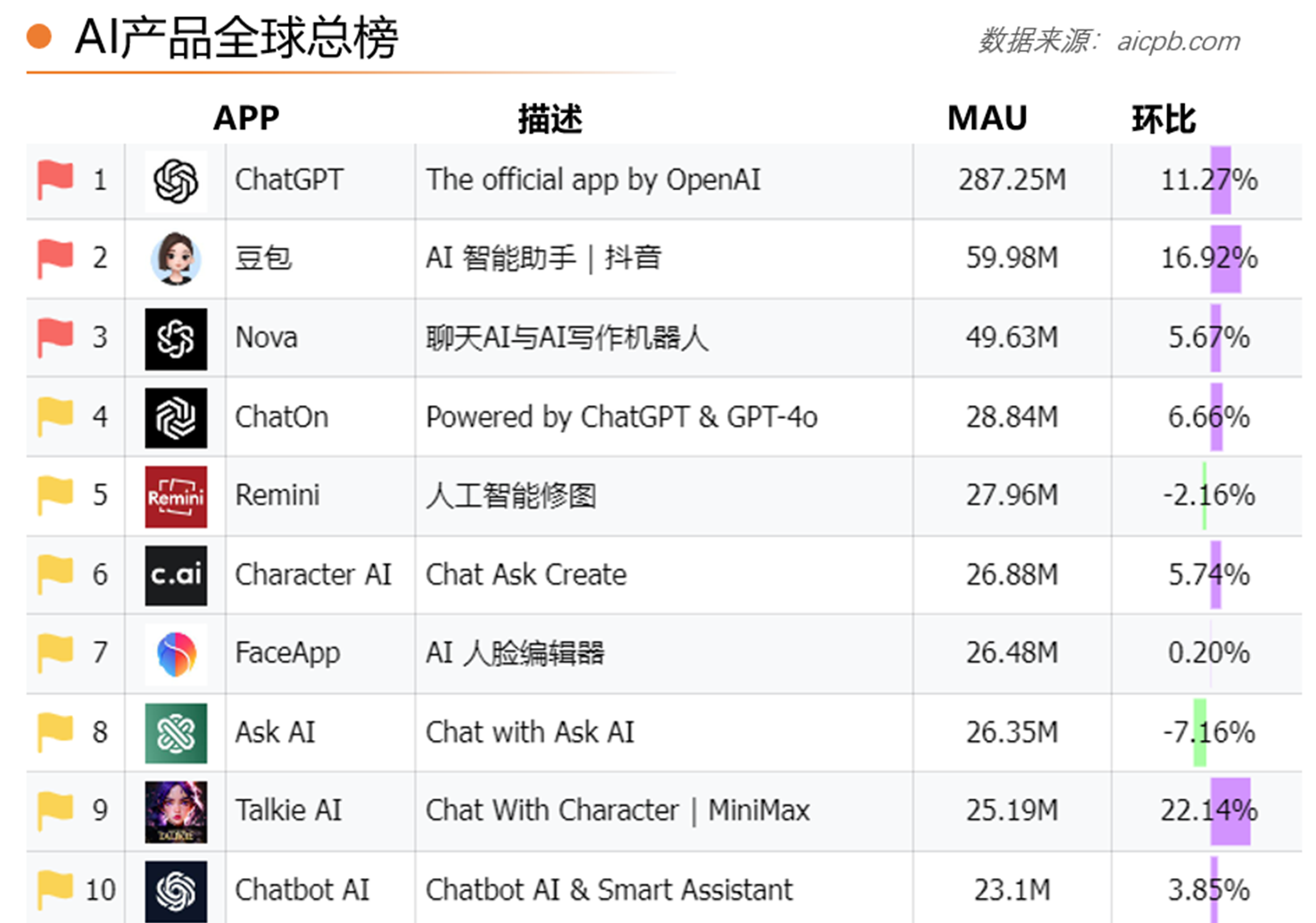

2024 has proven to be a year of explosive growth in the AI industry, especially within the mobile app sector. TakingChatGPTas a prime example, the monthly active users (MAU) for the app in January 2024 stood at 97 million, but by November, this number skyrocketed to 287 million—an astounding growth of 195.8%. Meanwhile, many standout products have emerged in specific subfields. According to the global AI app ranking released byaicpb.comfor November, there are some key trends worth noting:

● ChatGPT maintains a commanding lead in MAU, becoming the only app in the world with over 200 million monthly active users.

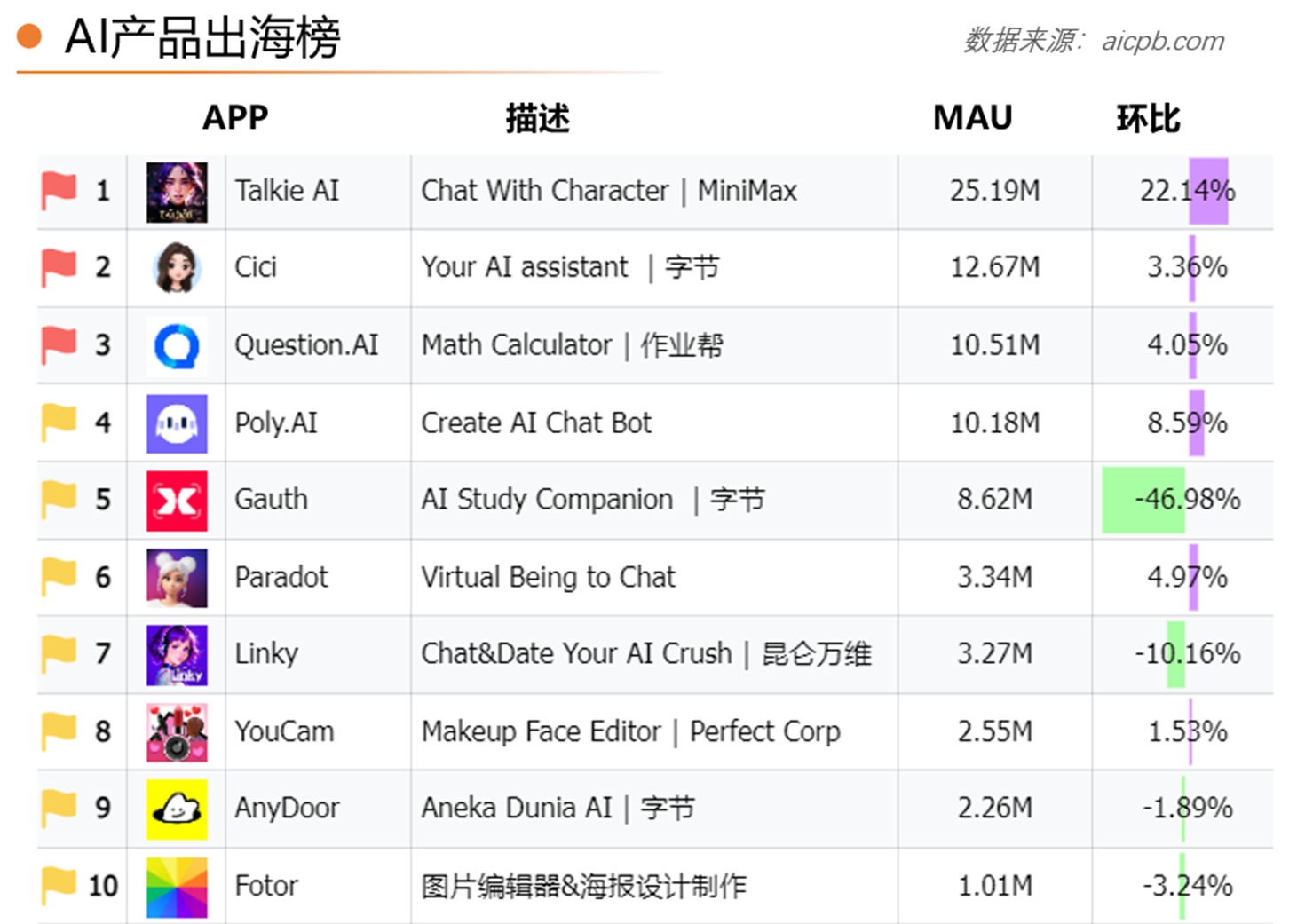

● China lacks top-tier products, with only 4 AI apps from Chinese companies having more than 10 million MAU in overseas markets.

● Among the outbound AI products, ByteDance's educational AI app has seen a notable drop in MAU, but its position remains solid.

● Image, video, and audio AI applications are growing the fastest, showing particularly strong market performance.

● Emotional companion apps have a stable market, though older products face high levels of homogeneity, and new products are growing more slowly.

1. November's Popular AI Applications

In November, the leading AI apps maintained their dominance, with only slight declines in the MAUs of two products. The most popular category was “chatbot” apps, with six products falling into this category.ChatGPTled the charge, with a MAU of 287 million, marking an 11.27% month-over-month growth, making it the world’s most popular AI app. Trailing behind wasByteDance's AI assistant, Doubao, which reached 59.98 million MAU, seeing a 16.92% increase. Notably, in addition toDoubao,Talkie AI—an AI companion app from MiniMax—also made it to the top 10, marking the only two Chinese apps on the list.

Chinese outbound AI products are primarily concentrated in three categories: "emotional companionship," "education," and "image editing." However, they still lag significantly behind overseas competitors, with only four apps maintaining over 10 million MAU. These apps includeTalkie AI (emotional companionship), Cici(AI assistant),Question AI (education), and Poly AI(emotional companionship). Among these, emotional companion apps are particularly popular, with five of them ranking in the top 10.ByteDance'seducational AI app,Gauth, saw a dramatic 46.9% drop in MAU, but it still placed three products in the top 10.

Source: AI产品榜 AI领域最权威的AI排行榜官网

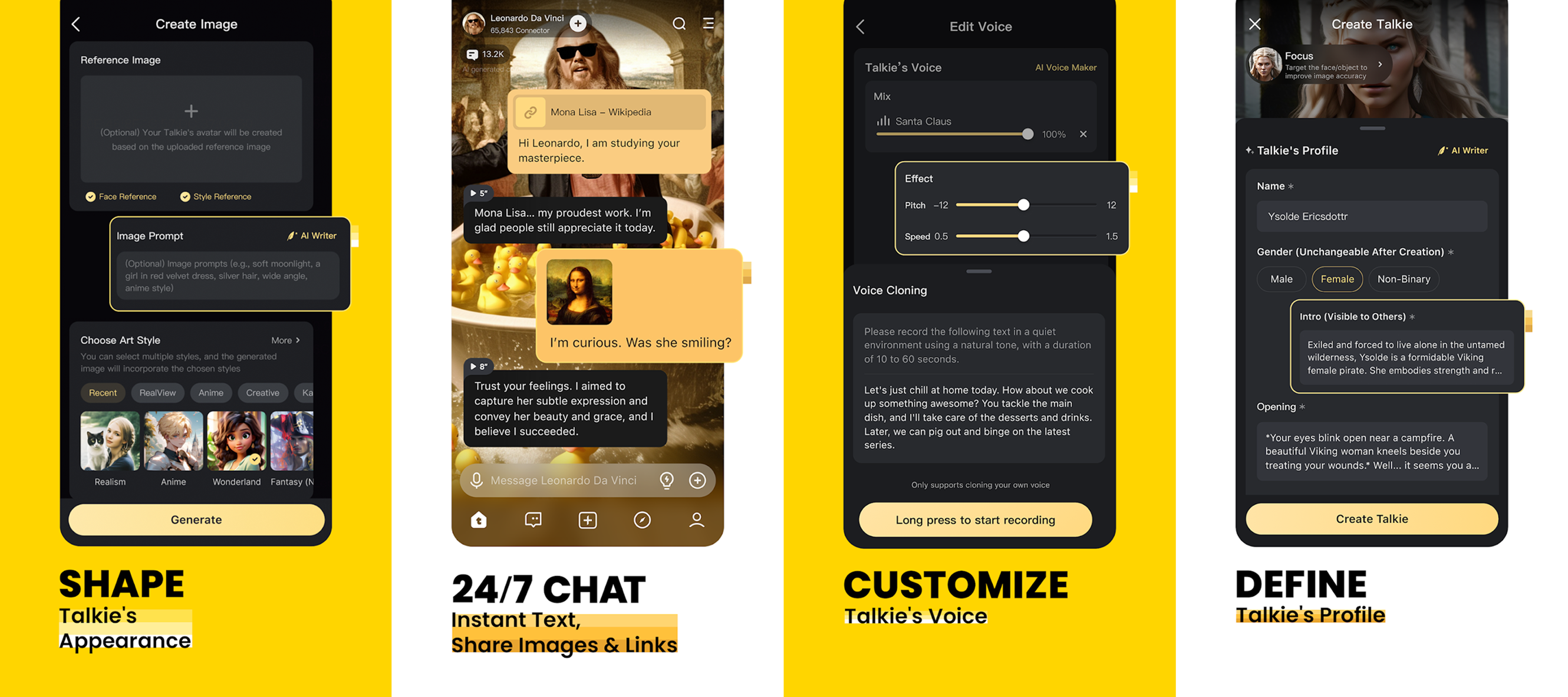

The "AI + companionship" sector remains one of the most commercially valuable AI application sectors. The technical barriers are relatively low, with the primary challenges lying in user experience and interaction. As more similar apps emerge, homogeneity in competition has become more pronounced. Leading products likeCharacter AIandTalkie AIhave built substantial user bases and advanced technology, securing a dominant market share, while newer products face slower growth.

Source: Talkie AI

2. AI Apps with the Fastest Growth in November

AI Chatwas the fastest-growing AI app in November, with its MAU soaring over 108.2% month-over-month to reach 3.97 million. In the top 20 apps with the highest growth in MAU, image and video-related AI applications were particularly outstanding, with several products leading the charge. Compared to emotional companion apps, AI tools tend to focus on specific functions, fulfilling users' needs in particular or single scenarios, which helps them differentiate themselves in the market. This has provided more opportunities for these apps to become breakout hits.

Source:AI产品榜 aicpb.com AI领域最权威的AI排行榜官网

For instance, the AI app CloneAI, which converts videos into cartoon-style imagery, saw its MAU increase by 96.5% in November, reaching 1.17 million. Artrix, an AI-based image generation app, grew by 92.7% month-over-month to reach 3.45 million MAU. Fotorama, an AI photo editing app, also saw a 52.4% growth in MAU, reaching 2.12 million. Additionally, AI apps like SelfyzAI (AI photo-to-video conversion) and AI Baby Gener (AI baby appearance prediction) also experienced rapid growth.

Source: AI Baby Gener

3. Popular AI App Marketing Strategies

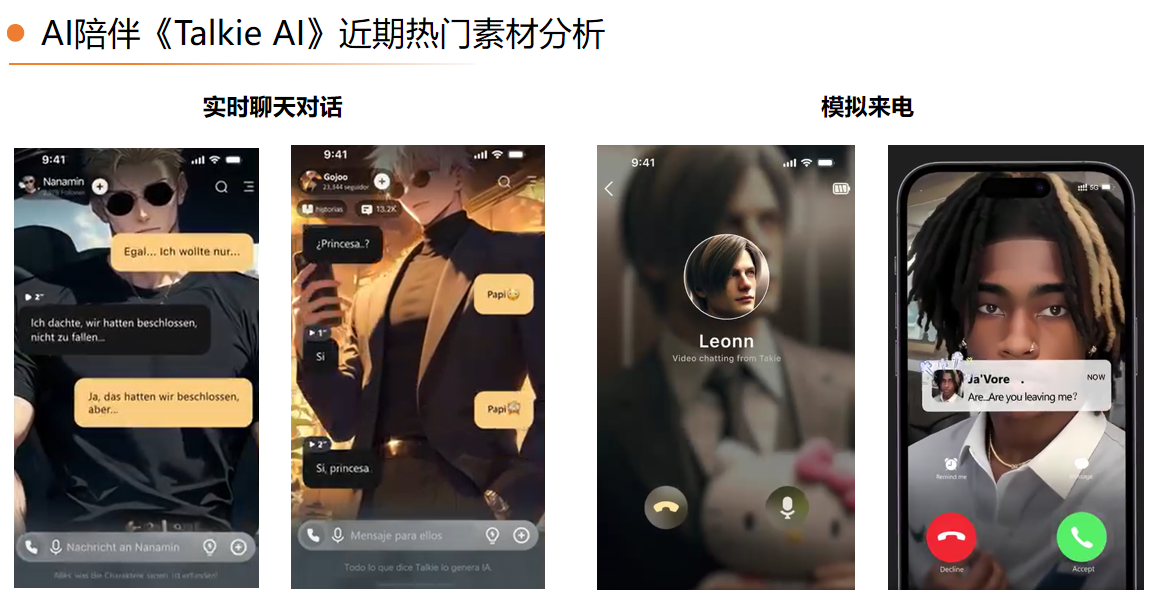

In addition to analyzing the monthly active users and download performance of AI apps, it's also important to examine their marketing strategies. High-quality advertising materials are crucial for product growth and user acquisition. Below, we'll analyze the marketing approaches of two popular AI apps.

The emotional companion app Talkie AI has recently focused its advertising on interactive experiences and scene simulations to touch on users' emotional needs and interests. Ads often feature conversations with highly popular AI characters, highlighting the product's strong interactivity and diverse character base. The content of these conversations sparks curiosity and encourages users to explore further, which enhances the ad's appeal. Additionally, some ads simulate incoming calls, creating a strong sense of immersion and emotional resonance, emphasizing the presence of AI companionship. This clever integration of everyday scenarios effectively captures user attention and boosts downloads, thereby improving conversion rates.

On the other hand, Remini, an AI photo-editing app, combines functional demonstrations with user-generated content (UGC) in its ads to attract users and reinforce its product value. The ads showcase the app’s rich creative features, such as photo-to-video conversion and AI baby appearance predictions, making it fun and engaging. Additionally, some ads leverage high-exposure UGC content from social media, turning it into second-generation creative content for targeted ads. This approach not only stimulates user participation but also helps build brand reputation and enhance user acquisition.