The Japan and South Korea markets have long been considered high-value regions in the global advertising industry, known for their high willingness to pay, ARPU, and strong purchasing power. With a mature mobile internet ecosystem and a growing demand for high-quality content, these markets provide significant potential for advertising spend and user monetization, making them key battlegrounds for developers and advertisers worldwide.

As 2024 draws to a close, let's take a look back at the key trends in the Japan and Korea mobile advertising market, popular sectors, leading advertisers, and advertising format trends.

01/ Mobile Advertising Market Performance Overview

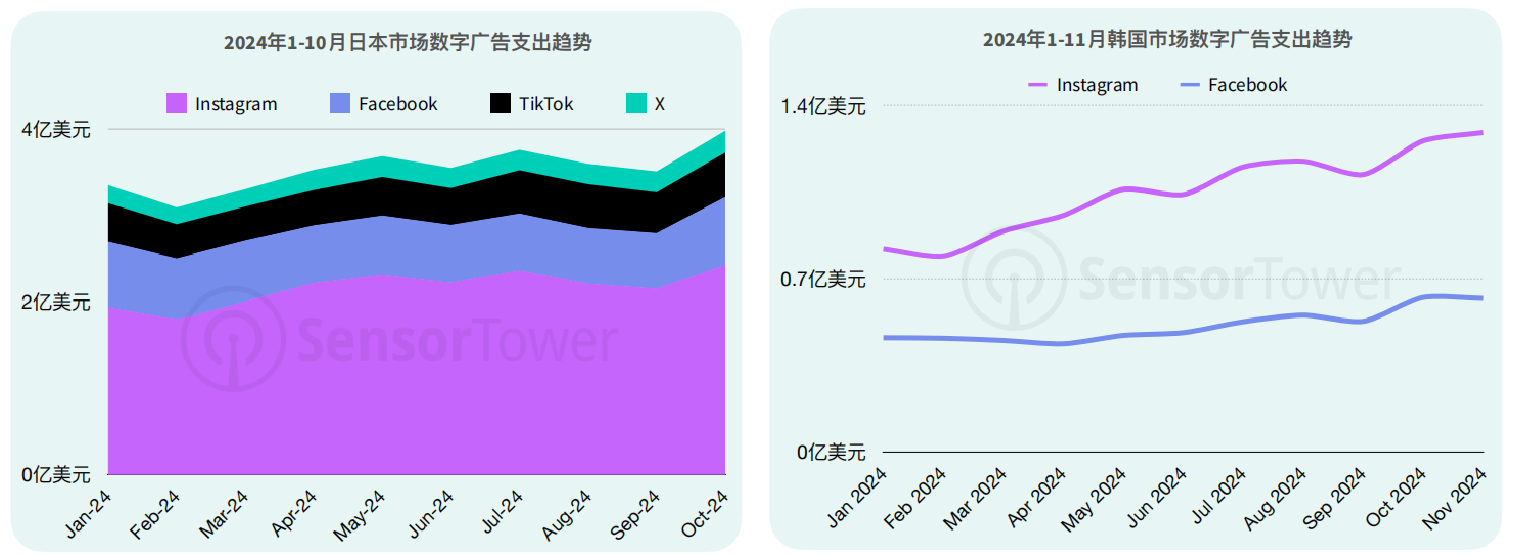

According to Sensor Tower, mobile ad spend in Japan and Korea exceeded $1 billion in 2024. From November 2023 to November 2024, Japan saw ad spend of $4.2 billion, generating over 96.8 billion ad impressions. In Korea, ad spend reached $1.75 billion from January to November 2024, with over 47.9 billion ad impressions.

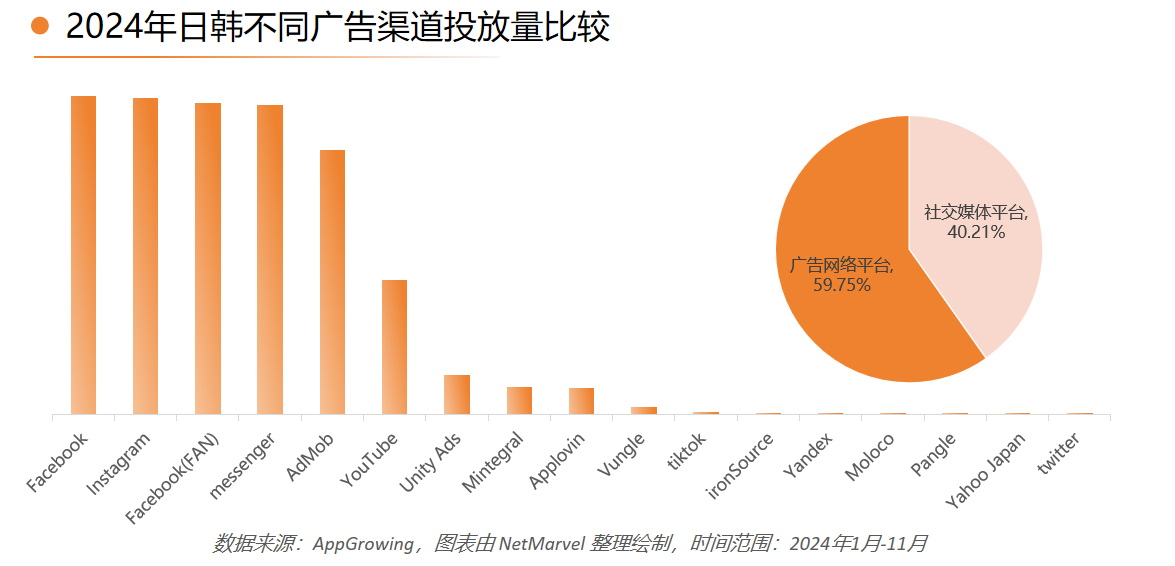

The top four platforms for ad spend in Japan and Korea are Facebook, Instagram, Facebook Audience Network, and Messenger. In Japan, ad spend on Instagram reached $2.2 billion, double that of Facebook. In Korea, Facebook and Instagram ad spend saw steady growth, reaching $200 million in November 2024, a 60% increase from January.

In terms of channel types, advertisers allocate 59.7% of their budget to advertising network platforms (Ad Networks) and 40.2% to social media platforms (Social Media). Notably, the share of social media channels has increased by 1.83% compared to last year, rising from 38.3%. This indicates that advertisers are becoming more flexible and diverse in their ad placement mix and budget allocation strategies.

02/ Leading Advertisers and Marketing Trends

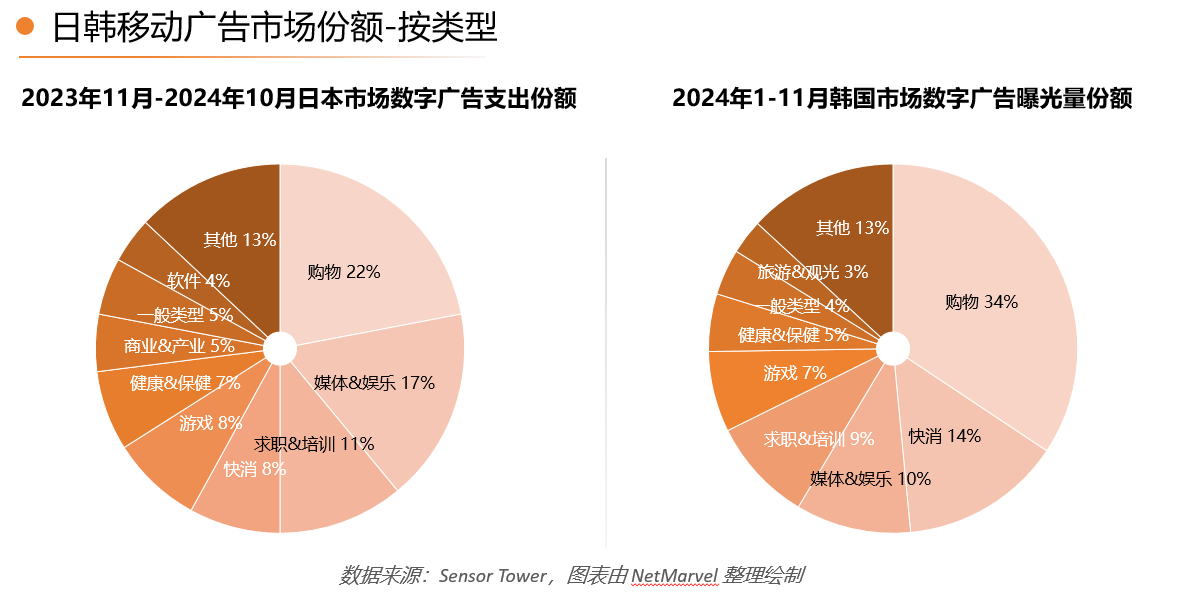

In both Japan and Korea, shopping-related advertisers dominate the market. In Japan, shopping, media & entertainment, and job & education sectors top the list, accounting for 22%, 17%, and 11% of total ad spend, respectively.

In Korea, e-commerce giant Coupang leads the market, accounting for 34% of total ad impressions. Fast-moving consumer goods (FMCG) make up 14%, followed by media & entertainment, job & education, and gaming advertisers with shares of 10%, 9%, and 7%.

In Japan, the top three shopping advertisers by ad impressions in the past year were Rakuten, Shein, and Temu. Rakuten remains a leading local platform with a substantial 23.6% market share. Shein and Temu, two Chinese platforms expanding internationally, have rapidly attracted large numbers of consumers in Japan, thanks to competitive pricing and a wide range of products.

In the gaming sector, NTT, Yostar, and Tencent are among the top advertisers.

In Korea, local e-commerce platform Coupang led ad impressions in the shopping sector, while Chinese platforms Temu, Alibaba, and Shein also ranked among the top ten. In gaming, Habby, a developer of mobile games like Capybara Go!, became the highest-advertising game publisher in Korea on platforms like Instagram and Facebook. They were followed by local game developers Netmarble and 111%.

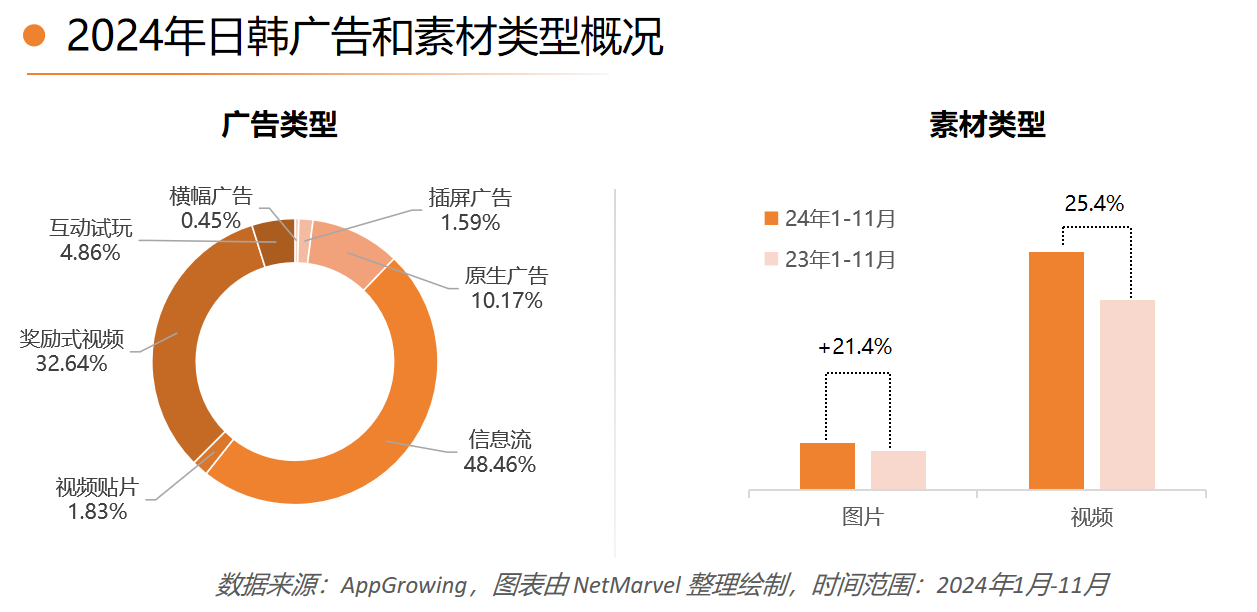

Advertisers in Japan and Korea are increasingly diversifying their ad types, focusing on making ads more native, interactive, and immersive to improve conversion rates. As a result, the share of banner and interstitial ads has significantly dropped, while in-feed ads have decreased from 52.94% to 48.46%. Native ads and interactive ads now account for 10.17% and 4.86%, respectively. Video ads dominate, making up five times as much as image-based ads.

03/ Growth Insights and Marketing Strategies for the Japan & Korea Market

Advertisers and developers need to tailor their strategies to the unique cultural, user preferences, and market characteristics of Japan and Korea. Here are a few targeted marketing recommendations:

1、 Emphasize Localization

Advertising and campaigns should highlight local culture, incorporating elements like holidays, pop culture, anime, and idols to create more engaging campaigns. Local celebrities and influencers have a significant impact in Japan and Korea, and leveraging these influencers for brand promotion can significantly enhance advertising effectiveness.

2、Precise Targeting

Both markets have clearly segmented user groups. In Japan, younger female users tend to prefer social games and beauty products, while in Korea, younger male users lean toward eSports and competitive games. Content should be closely aligned with the interests of these target groups.

3、Flexible Ad Channel Allocation

While Facebook and Instagram remain key platforms in Japan and Korea, expanding to additional channels can help reach a wider audience. Platforms like NetMarvel offer in-app traffic, DSP traffic, and Media Placement Services to target mid-to-long-tail users and acquire high-value customers. By adopting a cross-platform strategy, brands can extend their reach across multiple channels.https://www.netmarvel.com/en/media-advertising.html