Week 3 of August 2024

1. Tencent's net profit surges in the second quarter of 2024, with significant contributions from gaming

2. xAI releases the beta version of its developed model, Grok 2

3. The short video app "Scoopz" surpasses 4 million downloads

4. "Fishing Master" tops the U.S. iOS download chart

5. "TDS - Tower Destiny Survive" climbs the download charts

6. "DNF Mobile" drives Nexon's revenue to a record high

7. "PUBG" achieves double growth in users and revenue in the first half of 2024

8. Chinese manufacturers occupy half the market in the July mobile game advertising TOP 30

01. Tencent's net profit surges in the second quarter of 2024, with significant contributions from gaming

Tencent Holdings' performance was significant in the first half of 2024, with revenue reaching 320.62 billion yuan, a year-on-year increase of 7%. The second quarter, in particular, showed outstanding performance, with revenue of 161.12 billion yuan and a net profit of 47.63 billion yuan, a year-on-year surge of 82%.

In the gaming sector, Tencent's performance was especially prominent. Thanks to the steady growth of Tencent's leading games "Honor of Kings" and "Game for Peace", in the second quarter alone, Tencent's gaming revenue in the mainland market reached 34.6 billion yuan, a year-on-year increase of 9%.

At the same time, the overseas market also achieved excellent results, with international gaming revenue reaching 13.9 billion yuan, demonstrating strong revenue-generating capabilities. This success is also supported by strategic mobile game advertising, which plays a key role in driving the visibility and engagement of Tencent's games across global markets.

02. xAI releases the beta version of its developed model, Grok 2

On the afternoon of August 14th, xAI company officially released the beta versions of their star large language model AI models, Grok-2 and Grok-2 mini, to the public. Currently, X Premium and Premium+ users are already able to experience these two models.

Musk has very high expectations for Grok 2, believing that this AI model will surpass all the key indicators of the top AI models currently on the market.

Furthermore, the release of Grok 2 is just the beginning of xAI company's ambitious plan. Musk has revealed that the next generation in the Grok series—Grok 3—is actively being developed and is planned to be released before the end of the year. The goal for Grok 3 is to match or surpass OpenAI's GPT-5 model, which is the next major innovation widely anticipated in the field of large language models. If Grok 3 achieves this goal, it will set a new benchmark for the development of AI technology and push the entire industry forward.

03. The short video app "Scoopz" surpasses 4 million downloads

In 2017, "TikTok" emerged out of nowhere and swept across the globe with its viral popularity, since then, the short video application market has been eyed covetously by numerous manufacturers.

This March, the U.S. House of Representatives passed a bill sanctioning "TikTok," demanding that ByteDance relinquish control of TikTok within 165 days, otherwise, the app would be removed from the U.S. market.

Against this backdrop, various manufacturers seized the opportunity to launch their own short video applications. "Scoopz" is one such product.

The short video application "Scoopz," which focuses on sharing real-life moments, rode the wave of "TikTok" being sanctioned in the U.S. and saw a surge in downloads, breaking through 4 million by August 12th.

04. "Fishing Master" Case tops the U.S. iOS download chart

On August 10th, the overseas version of "Happy Fishing Master" published by Tourist Games, titled "Fishing Master," went live globally.

After the game's launch, it achieved remarkable success. It not only quickly climbed to the top of the U.S. iOS download chart but also entered the top ten of the iOS mobile game download charts in 31 countries, including Japan, Finland, and New Zealand, within just two days, securing the number one spot in Japan.

From a business perspective, "Fishing Master" has also made an impressive impact. As of August 11th, its daily revenue reached $100,000, which is not far behind the daily revenue of the established leading product "Fishing Master," which earns between $120,000 to $150,000 a day.

These figures indicate that "Fishing Master" occupies at least the Top 2 position among games of the same genre.

05. "TDS - Tower Destiny Survive" climbs the download charts

"TDS - Tower Destiny Survive," a successful casual tower defense game released by SayGames, has achieved significant results on both iOS and Android platforms.

On the iOS platform, it has successfully entered the top 10 RPG game charts in more than 20 countries and regions, including Denmark, Taiwan of China, Germany, Singapore, Japan, and South Korea, and it also ranks in the top 50 on the overall game charts.

On the Android platform, it is ranked first in the action game charts in the United States and has entered the top 10 in the charts of 45 regions.

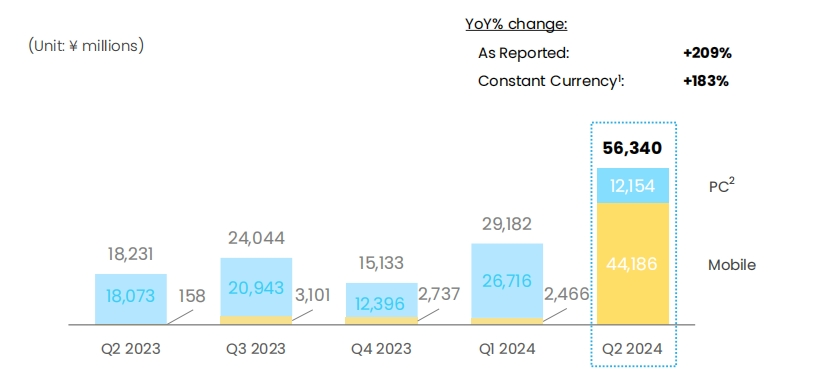

06. "DNF Mobile" drives Nexon's revenue to a record high

Nexon's financial report indicated that, propelled by the Chinese version of "DNF Mobile," the company's revenue reached a record high of 122.5 billion Japanese Yen (approximately 6 billion Chinese Yuan) in the second quarter of 2024. Particularly in the Chinese market, Nexon generated revenue of 56.3 billion Japanese Yen (about 2.7 billion Chinese Yuan) in the second quarter of 2024, which is nearly twice the figure of the first quarter. The income from mobile games surged from 2.5 billion Japanese Yen (about 100 million Chinese Yuan) in the first quarter to 44.2 billion Japanese Yen (approximately 2.2 billion Chinese Yuan) in the second quarter, while the income from PC games saw a decline.

Since "DNF Mobile" was launched in the China region on May 21st, it has had a significant positive impact on Nexon's revenue in China. In the first half of 2024, Nexon's revenue in the China region was 85.5 billion Japanese Yen (a year-on-year increase of 39%). The growth in the second quarter was particularly notable, reaching 56.34 billion Japanese Yen, a year-on-year increase of 209% compared to the same period in 2023. This suggests that "DNF Mobile" has made a substantial financial contribution to Nexon, becoming a major driver of the company's revenue growth. Additionally, in-game advertising examples, such as ads integrated into "DNF Mobile," have played a significant role in monetization, further boosting Nexon's revenue in the mobile gaming market.

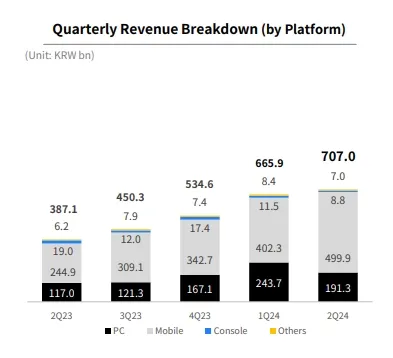

07. "PUBG" achieves double growth in users and revenue in the first half of 2024

According to the latest half-year financial report published by Krafton, the developer of "PUBG," the game achieved significant user growth and revenue increase in 2024. Specifically, the Monthly Active Users (MAU) for the PC version increased by 40% compared to last year, and the number of paying players increased by 130%. On the mobile side, the Daily Active Users (DAU) saw a 30% increase from the previous year, while the number of paying users grew by 40%.

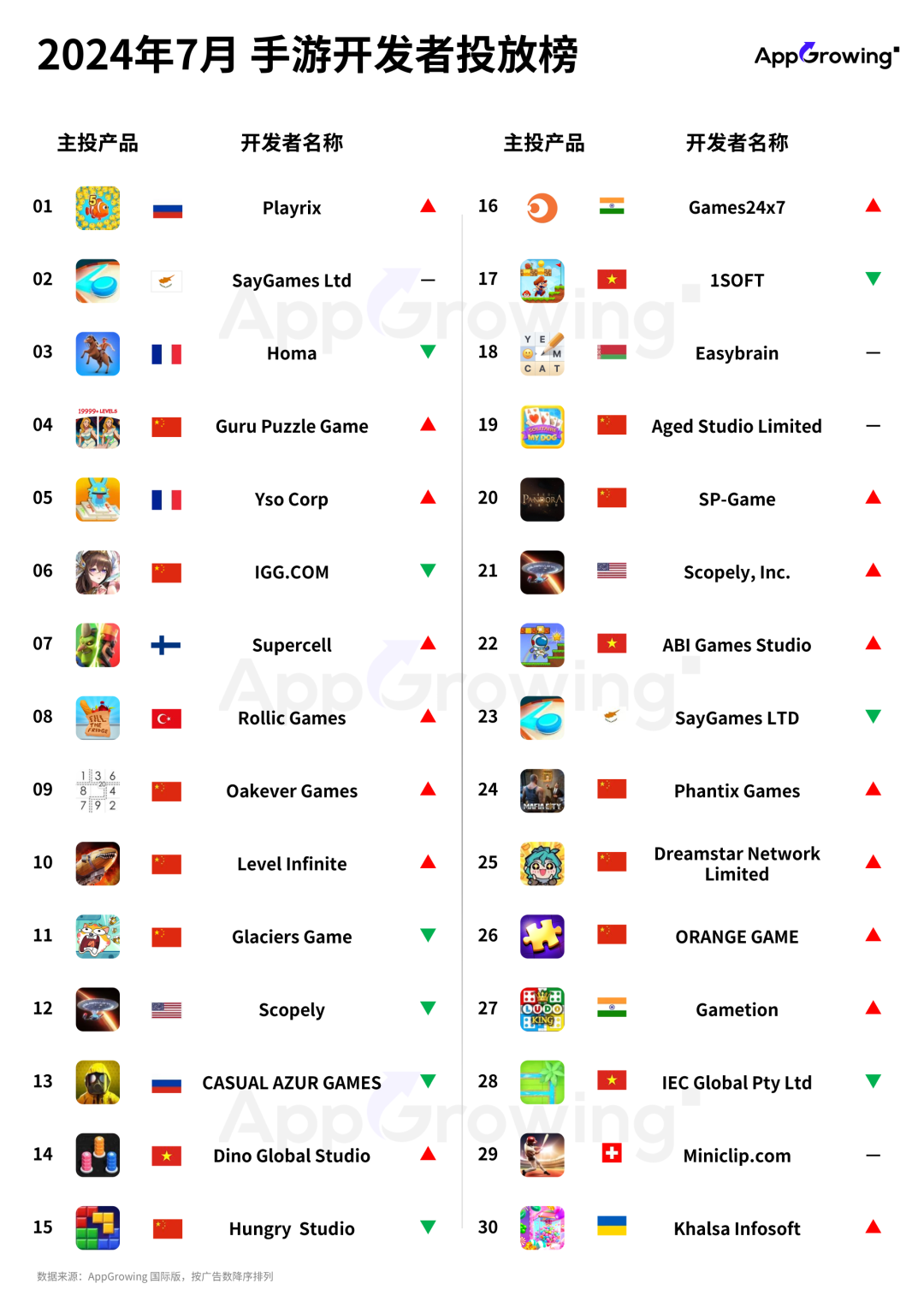

08. Chinese manufacturers occupy half the market in the July mobile game advertising TOP 30

Based on data monitoring from the international version of AppGrowing, in the July mobile game developer advertising rankings TOP30, there were 10 Chinese manufacturers who made it into the TOP30 list, demonstrating the competitiveness and influence of Chinese mobile game developers in the international market.

Among them, only Guru, a company focusing on the casual gaming sector, made it into the TOP5. This may mean that casual games currently have a high appeal and user base in the international market.

It is also noteworthy that Tencent's advertising volume is growing continuously, and its ranking has risen to the top ten, indicating that Tencent is intensifying its promotion efforts in the mobile gaming market, and its products may have received a positive response in the international market.

Overall, the manufacturers in the TOP30 mainly focus on light to medium game categories, which may be related to these types of games being easy to pick up and having a broad audience.