Entering the era of stockpiling, the global mobile game market is facing severe challenges. Data shows that by 2023, global downloads on both App Store and Google Play will decrease by 10% compared to the previous year, and in-app purchase (IAP) revenue will also decline by 2%. As a key category in the market, medium to heavy mobile games are the most affected. Taking RPG and SLG categories as examples, despite being known for long-term operations and high ARPPU (average revenue per paying user), the market concentration is too high, with major products currently dominated by large companies, and the rate of new games making it to the top is extremely low. Top products still occupy the majority of the market share.

Against the backdrop of such "solidification of top products and lack of new strength", more and more manufacturers have to start rethinking how to find new breakthroughs in an environment where market growth is slowing down.

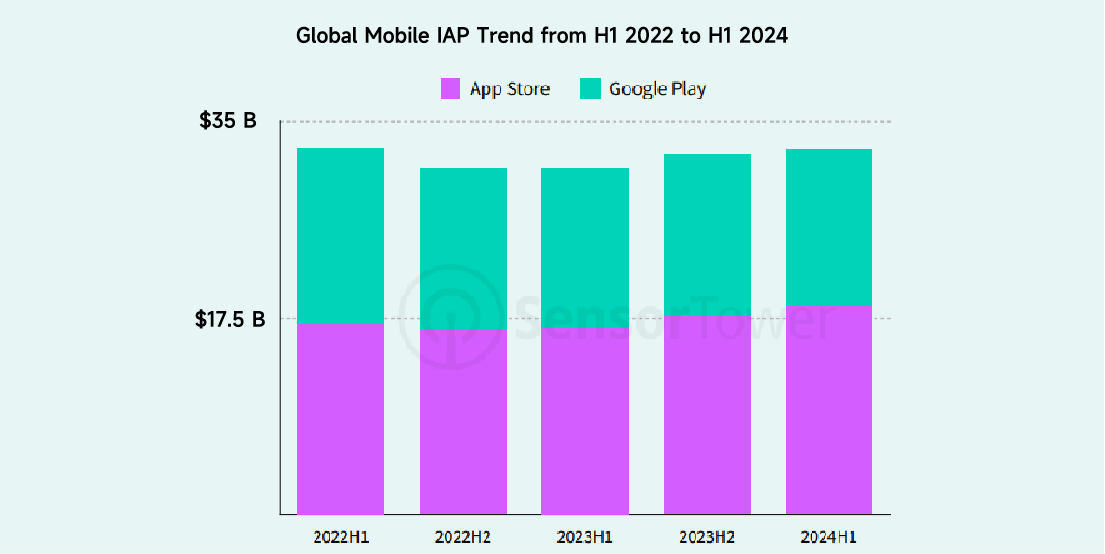

Despite the ongoing market weakness, there is a trend of recovery in the global mobile game market in the first half of 2024.

According to Sensor Tower data, overseas mobile game revenue showed an upward trend in the first half of 2024. Revenue from the App Store and Google Play channels increased by 6% year-on-year, reaching $32.5 billion. Among these, casual categories such as chess, puzzles, and simulations became the main driving force. The growth of casual categories against the trend is also an important reason for the accelerated "Casualization" of the mobile game market.

Currently, the "Casualization" of the mobile game market mainly presents two characteristics.

Firstly, the "Casualization" of medium to heavy mobile games. Traditional medium to heavy mobile games (such as SLG, RPG) usually feature complex gameplay, high strategic elements, and deep content, requiring players to invest a lot of time and effort. However, with the diversification of mobile game user groups and the trend of fragmented player time, more and more medium to heavy mobile games are incorporating elements and design concepts of casual games to attract a wider range of users, especially those seeking a relaxed gaming experience. Earlier this year, "Last War: Survival" stood out by merging casual gameplay with SLG, becoming the highest-grossing product in overseas mobile game revenue in the first half of the year.

The success of "Last War: Survival" is attributed to the integration of innovative gameplay. In the early stages of the game, players were attracted through fun mini-games such as parkour, mowing grass, and tower defense. The SLG gameplay was adjusted to be more lightweight, such as obtaining most resources through automatic placement, reducing the strategic threshold of the game, allowing casual players to enjoy the game.

Source:《Last War: Survival》

Another manifestation of "Casualization" is the transition from hyper-casual to mixed-casual. Hyper-casual games rapidly rose to prominence due to their simple mechanics and easy-to-understand gameplay, but as the market becomes saturated, players quickly lose interest in games with a single core mechanism, leading to lower player retention rates. To address this issue, developers have started exploring new features and mechanisms to attract players and improve retention rates, leading to the evolution towards mixed-casual games. Games like "Magic Tiles 3" and "Survivor.io" have successfully attracted numerous players by adopting a mixed-casual mode.

As we enter the second half of 2024, casualization, lightweight design, and integrated gameplay have become the driving forces for many developers to expand internationally.

Mixed monetization becomes a new force for income growth

On the other hand, the strengthening trend of casualization in mobile games is also reflected in monetization strategies.

In terms of monetization models, according to data from AppsFlyer, in the first half of 2024, global mobile game market overall IAP declined on both Android and iOS platforms, with a 15% decrease on Android and a 35% decrease on iOS. However, despite a 10% decrease in IAA on iOS, it increased by 12% on Android, with significant increases in hyper-casual, puzzle, and simulation categories. This indicates that casual IAA mobile games currently demonstrate stronger resilience and growth potential in terms of ad monetization.

It is worth noting that as the trend of casualization and mixed-casual strengthens, more developers have transitioned from the previous single monetization model to mixed monetization. In the second quarter of 2023, 19% of hyper-casual games adopted mixed monetization, and by the second quarter of 2024, this proportion had surged to 26%. Additionally, categories such as gambling, medium to heavy segments like RPGs, SLGs, and shooters that have adopted mixed monetization have also shown growth rates ranging from 7% to 10% (gambling and RPGs increased by 10%). It can be said that mixed monetization has become an important driver of revenue growth in mobile games today.

Focusing on the market and deep localization is key

"Casualization" itself does not guarantee success; the key to international success lies in focusing on the market and deeply localizing the game.

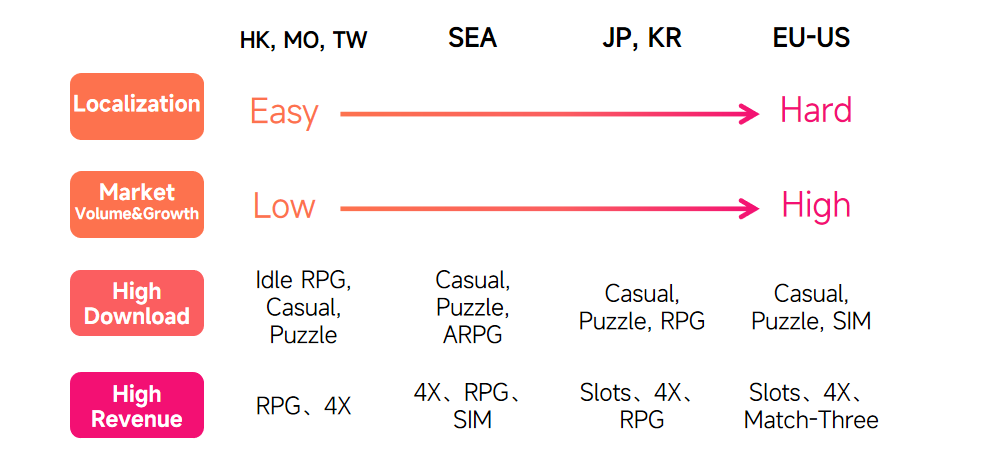

Different regions have diverse cultural backgrounds, aesthetic preferences, and player types, so most mobile game internationalization strategies follow the guideline of "the market determines gameplay themes and also determines the difficulty of game localization." For example, in regions like Hong Kong, Macau, Taiwan, Japan, and Korea, the difficulty of mobile game internationalization is relatively lower due to the influence of the "Chinese-East Asian cultural sphere." Developers find it easier to meet player demands by catering to popular theme preferences and making localization adjustments. Therefore, recent RPG mobile games like "Gum Heroes Legend" and "Little Monster Road" have achieved good results locally.

In the European and American markets, despite the greater difficulty of localization, these regions remain the preferred markets for many developers due to their large user base and revenue potential. According to Sensor Tower data, in the first half of 2024, the United States, Europe, and Japan and Korea maintained their positions as the top T1 markets for mobile game revenue. In the United States, App Store and Google Play mobile game revenue increased by 20% and 8% year-on-year, respectively. Despite a decrease in downloads, revenue is on the rise. Furthermore, the preference of European and American players for hyper-casual games presents significant market opportunities for developers looking to expand internationally.

Therefore, when choosing markets, developers can consider their product's strengths and market fit to make decisions. For example, products with "Eastern culture" art themes and character designs are more suitable for entering culturally similar markets such as Hong Kong, Macau, Taiwan, Japan, and Korea. On the other hand, products with significant advantages in gameplay innovation and interactivity have more potential for success in the European and American markets.

To combat internal competition and find the best traffic opportunities

"Casualization" is the current trend, but with the influx of developers and the rapid increase in the number of products, competition is becoming increasingly fierce. Relying solely on mainstream user acquisition channels like Google and Meta media platforms may struggle to effectively address the issues of homogenized competition and traffic growth bottlenecks. This is especially true in the IAA mobile game industry, where accurately covering target audiences more broadly and precisely poses the greatest challenge.

As a leading performance advertising platform in the industry, NetMarvel has become the preferred partner for developers due to its extensive experience and strong presence in the European, American, Japanese, and Korean markets. With over 500 high-quality products covering various mobile game subcategories such as casual, puzzle, and RPG, and a global monthly active user base of over 100 million, NetMarvel can helpIAA games accurately reach more mid to light casual players, tapping into long-tail traffic.

Additionally, NetMarvel offers diversified advertising strategies tailored to different markets and audience characteristics, developing ad content and deployment plans accordingly. By utilizing precise user profiles and behavioral analysis to flexibly adjust advertising strategies in a dynamic market environment, NetMarvel maximizes advertising effectiveness, assisting more advertisers in achieving high-quality user acquisitions in the current wave of "casualization."