In the context of a global "traffic bottoming," Brazil remains one of the few markets still on an upward trend.

As early as the nineteenth century, Brazil was once gold rush mecca, attracting people from various countries to go there in succession, seeking fortune. Today, in the era of the internet, Brazil has once again sparked a new gold rush, becoming a popular destination for numerous manufacturers to go global.

In this country brimming with samba enthusiasm, how can one successfully venture overseas? In this article, we will combine the latest data and experiential analysis to help manufacturers and advertisers understand the current situation and development trends of the Brazilian market, achieving a strategic position of knowing both themselves and their competition.

The release of the internet dividend, the mobile gaming industry continues to grow.

In recent years, the internet bonus of the Brazilian market has been gradually released.

By 2024, the population of Brazil is 217 million. The internet penetration rate is 86.6%, which is an increase of nearly 10% compared to 2023. This means that currently, there are nearly 180 million internet users in Brazil.

From the perspective of the internet user structure, there are several main characteristics:

1. Youthfulness: The millennial generation is the main force of the internet.

2. High daily average online time: It reaches more than 9 hours.

3. Increased mobile internet usage time: The daily average time spent on mobile phones is around 5 hours.

4. Strong social needs: The time spent on social media (such as Facebook, Twitter, etc.) is nearly 4 hours.

5. Strong entertainment orientation: The number of gamers is as high as 108.5 million, accounting for over 60% of internet users.

Therefore, the mobile gaming industry in Brazil has a superior growth environment. It is understood that Brazil's mobile game download rate far exceeds that of console and PC, reaching 87%, ranking second in the world.

In terms of market size, the revenue of Brazil's mobile gaming market reached 6 billion RMB in 2023, with a year-on-year increase of 2.3%. In 2023, the number of game studios in Brazil reached 1,042, with a year-on-year growth of 3.2%. This also indicates that the mobile gaming industry in Brazil is flourishing.

The cost of acquiring customers is low, and the trend of buying traffic is heating up.

Despite being a developing country, Brazilian users often exhibit a high willingness to try and pay for new things.

Looking at player profiles, the Brazilian gamer community is predominantly young people and women, with users aged 18 to 34 accounting for nearly 60%, and the proportion of female users reaching 52%. Therefore, when it comes to game design and marketing strategy, the preferences of female users should not be overlooked by manufacturers.

According to statistics, Brazil ranks among the top five globally in the number of mobile game downloads on the iOS platform. Looking at the segmented tracks of mobile games, over 50% of the total game market revenue in Brazil comes from puzzle games, strategy games, role-playing games, and simulation games. Additionally, there are several points worth noting:

1. Strategy games are the most profitable: Strategy games, represented by titles such as "Clash of Clans" and "Mobile Legends: Bang Bang," are the highest-grossing type of mobile game in the Latin American market.

2. Android has a higher market share, but iOS has a higher pay rate: Android phones hold about 90% of the market share in Brazil, contributing to the majority of mobile game downloads; however, iOS users account for 56% of spending, supporting a large market with a smaller volume.

3. Preference for long-term operations: According to the 2024 bestseller list, the top eight spots are all occupied by casual games, and all the games on the list have been in operation for over a year.

On the other hand, as the Brazilian market's vitality becomes increasingly apparent, the competition among companies for advertising and user acquisition is heating up.

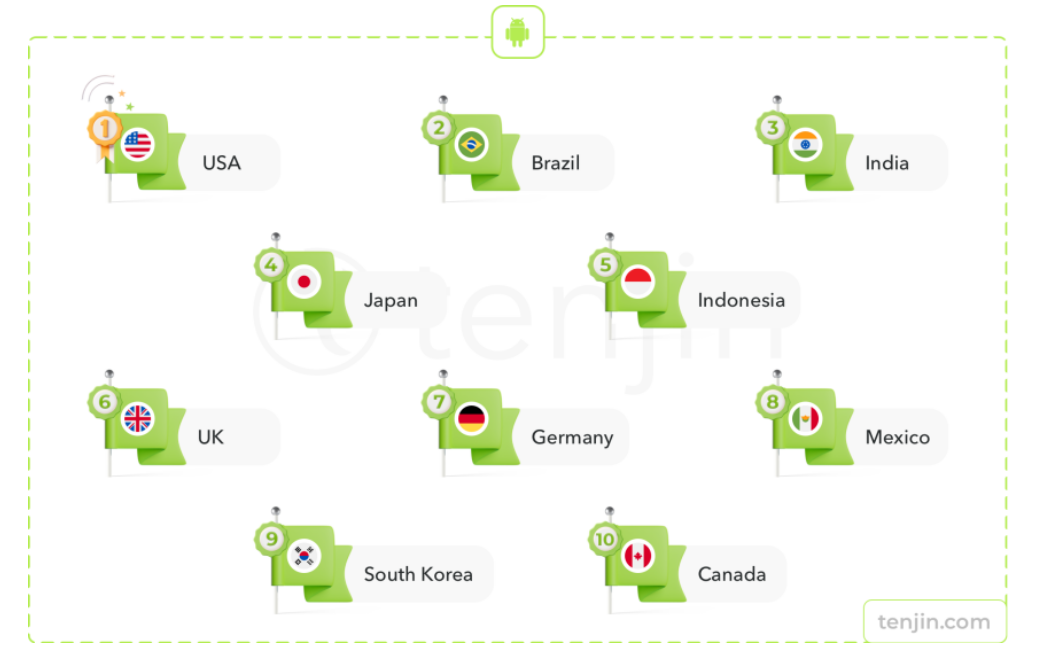

According to data from Tenjin, in 2023, Brazil ranked second among the top 10 countries in advertising spending (counting Android platform, hyper-casual and casual mobile games). However, Brazil's average CPI (Cost Per Install) is only $0.07 USD, which ranks seventh among the top 10 countries in advertising expenditure.

From the monetization perspective, the NetMarvel team points out that the eCPM (effective Cost Per Mille) in Brazil can be stably maintained above $25, with a payback period controlled within 5-7 days, making it one of the best-performing countries in non-Tier 1 markets. Clearly, Brazil is a market of high potential and high efficiency for advertisers.

Due to the low customer acquisition cost and good advertising effectiveness, the Brazilian market naturally attracts attention from global manufacturers. According to the bestseller list published by AppMagic, over 90% of the top 100 best-selling mobile games in Brazil are from overseas developers.

03. Mastering Brazil: Key Points for Marketing Growth

In the Brazilian market, localization is essential. Unlike other Latin American countries, Brazil’s official language is Portuguese, uniquely influenced by African, Italian, and other cultures, resulting in Brazilian Portuguese as the primary language. Additionally, Brazil’s diverse population, with roots from Europe, the Middle East, and Asia, contributes to a rich cultural backdrop.

Brazil’s mobile user base skews young, with a strong focus on entertainment, social interaction, and a robust UGC (User-Generated Content) culture. Millennials, who dominate the mobile user group, are particularly engaged with UGC video content in genres like comedy, variety, and spontaneous videos. Social interaction is also a priority, with 38% of players reportedly willing to pay for games that allow play with family and friends.

When developing marketing solutions and materials, it’s strategic to appeal to women, as they represent 52% of the Brazilian mobile gaming market. This demographic shows a higher willingness to spend, with female gamers exhibiting more emotional engagement and purchasing inclination than their male counterparts.

For mobile game advertisers, Meta, Instagram, and Twitter are highly effective channels in Brazil due to their widespread use. Approximately 90% of Brazilian internet users have a Facebook account, while Instagram also boasts a significant user base of around 35 million, making these platforms top priorities for reaching Brazilian users.