Chinese Short-form dramas overseas are continuing to pay off big time with this billion-dollar trend.

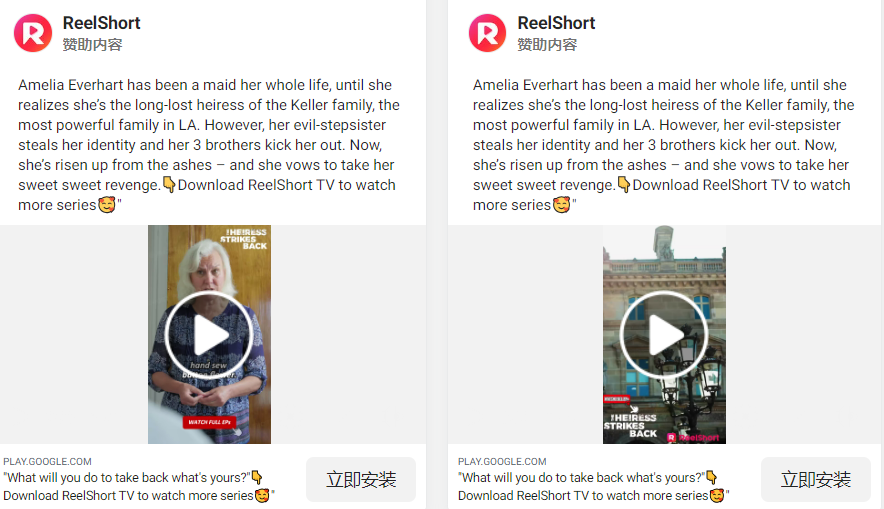

At the beginning of this year, Chinese short dramas “Fated to My Forbidden Alpha” and “The Double Life of My Billionaire Husband” which have been online for less than six months, have achieved a viewership of 110 million and 270 million respectively on ReelShort, becoming another milestone in the short dramas overseas since 2022. Elements you'd expect in a short drama, like "Rich and powerful CEO falls in love with Cinderella at first sight", "The heroine seeks revenge", and "Identity reversal" are being adapted without change for overseas audiences' mobile screens, attracting more and more users to subscribe and pay.

Currently, the earliest short drama companies only spend less than two years expanding overseas, but the competition has entered a stage of intensive cultivation. From platforms to users, the supply of short dramas is going to be industrialized and standardized. According to Nan Yapeng, vice president of Crazy Maplet Studio, "ReelShort" will achieve a production capacity of launching 2 original short dramas per week.

From the explosion to the current state two years later, let's take a look at what's certain and what's up for grabs in the global short-drama market.

01/Market Overview

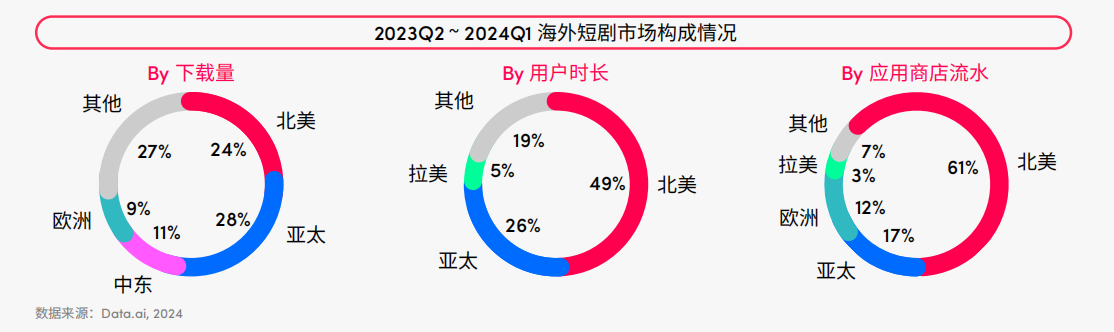

The global short drama market is in an explosive growth phase, with download numbers skyrocketing from the millions to the tens of millions between 2023 and 2024. In 2024, the monthly user base surpassed 20 million. The industry's commercial potential is enormous, projected to reach a multi-billion dollar market size in the future.

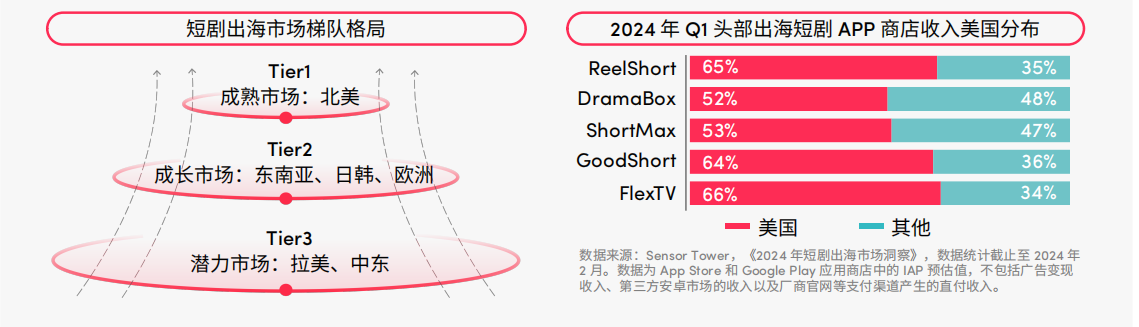

The global short drama market has formed a three-tier structure. At the forefront is the mature North American market, led by the United States, which boasts a superior business environment and a well-developed film and television industry system compared to other markets. From script selection to casting and production to video editing, and finally, to platform launch and other streaming media, the entire cycle can be compressed to within a month. Moreover, American users are accustomed to paying for and subscribing to entertainment content, making it the top choice for short dramas going global. According to Sensor Tower data, among the top short drama apps going overseas, the proportion of in-app revenue from the United States is more than 50%.

Additionally, "ReelShort's" viral success stems from three key drivers: Beyond North America's revenue lead, emerging markets like Southeast Asia, Japan, and Korea, and prospective regions such as Latin America and the Middle East present sizable opportunities. Notably, the Asia-Pacific region excels in short drama app downloads and user engagement times.

Chinese Short dramas, centered on satisfying "high points," cater to varied market tastes. Western markets blend the "billionaire boss" trope with fantasy elements like vampires and werewolves. Southeast Asian audiences prefer a mix of romance, family rivalries, heart-wrenching love, rags-to-riches stories, and family ethics. In contrast, South American audiences, particularly in Brazil, are hooked on high-stakes themes like gang conflicts and war.

02/ Leading APPs

According to Sensor Tower, the global market for short dramas has seen a surge in popularity over the past year. By the end of February 2024, more than 40 short drama apps had ventured into international markets, amassing nearly 55 million downloads and $170 million in in-app revenue. When considering a combination of downloads, user base, and app revenue, the leading apps in the global market are primarily ReelShort, DramaBox, and ShortMax.

"ReelShort", a product of Crazy Maplet Studio, launched the global market in August 2022. Data shows that it dominates the global short drama app market with a 52% share of downloads and a 48% share of revenue, making it the "super app" in the genre. In August, "ReelShort" is projected to hit 7 million downloads and an estimated $23 million in in-app purchases.

The hit of"ReelShort" is primarily driven by three factors: prior expertise in taking web literature global, focusing on script quality, and ongoing advertising momentum. Before launching "ReelShort," the team had already navigated the international novel app market, amassing valuable insights into market dynamics and user preferences, which set the stage for "ReelShort's" success. Meanwhile, aggressive advertising has contributed to 78% of its download volume.

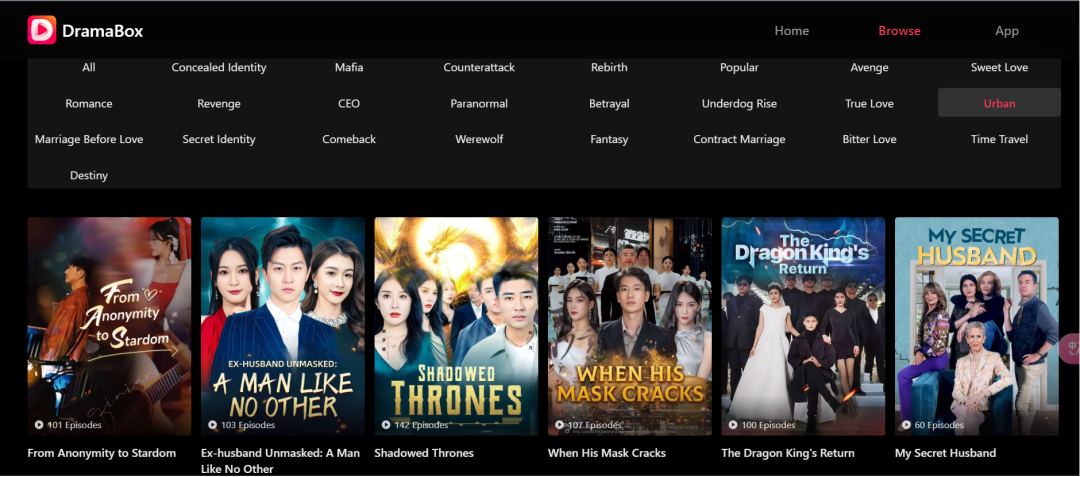

"DramaBox," developed by Dian Zhong Tech, launched overseas in April 2023 and has quickly broken into the million-dollar revenue bracket. It's on track for 10 million downloads and $23 million in in-app purchases for August. With a niche focus on translated Chinese short dramas catering to a male demographic, "DramaBox" has seen its male user ratio soar to 43.5%, nearly half, as reported by Diandian Data.

"ShortMax," introduced by Jiuzhou Culture to international audiences in September 2023, is already making waves with an impressive track record. According to Sensor Tower, the app is forecasted to garner 9 million downloads and a projected $16 million in in-app spending for August.

03/Globalization Trends

The global short drama market has transitioned from infancy to rapid expansion. Yet, this growth spurt also ushers in fiercer competition. Sensor Tower indicates that the top three players in this space now hold a commanding share of over 70% of the market's revenue.

Newcomers face a steep climb in an arena dominated by established players with a stranglehold on resources. The disparity spans funding, tech, and extends to user base aggregation, content creation prowess, and global operational acumen. To break into this fray, entrants need to arm themselves with innovative business models, and distinctive product strategies, and exhibit heightened execution and adaptability, thriving in such a competitive ecosystem.

Conversely, the integration of AI has catalyzed a transformative shift within the short drama industry. AI's role surpasses creative processes like script crafting and character development, playing a crucial part in script translation and content adaptation. For example, AI-driven facial replacement technology can regionalize characters by swapping features, enhancing cultural resonance with foreign viewers, and substantially reducing production expenses.

Kunlun Tech has debuted "SkyReels," the inaugural global AI-powered short drama platform, transcending the "one person, one plot" idea from concept to reality. With the maturation of AI, the future of Chinese short dramas is poised to become exceedingly tailored and bespoke. Evolving from mass-market to niche and even personalized viewer experiences, this trend foretells further market segmentation and profound exploration in the short drama industry.